THE TELEGRAPH: Goldman Sachs has angrily defended itself against a public campaign that claims the bank is exacerbating global food crises through its commodity trading operations.

The Wall Street bank has dismissed as "disingenuous and downright misleading" the conclusions by the World Development Movement that its activities have led to increased food prices, food riots, and poverty around the world.

The WDM, a London-based non-governmental organisation, on Monday started an on-line campaign to persuade the public to report Goldman to the Financial Services Authority (FSA) as the biggest bank allegedly distorting commodities markets.

The organisers said they want to put pressure on authorities to limit the ability of banks and hedge funds to trade in commodity futures.

The move came as Armajaro, a hedge fund run by Anthony Ward, was accused of cornering the cocoa market and pushing up prices after buying £650m, or 240,000 tonnes, of cocoa beans.

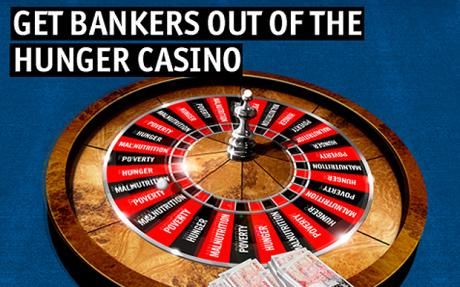

The campaign follows the publication of a report by the WDM called The Great Hunger Lottery: how banking speculation causes food crises, in which the lobby group accuses banks and hedge funds of "gambling on hunger." The report concludes that commodity trading is "dangerous, immoral and indefensible." >>> Louise Armitstead | Tuesday, July 20, 2010