SKY NEWS: On the day the OBR revised up forecasts, Sky's Jeff Randall hears what Lord Razzall and Lord Bell have to say on the UK economy. The Tory peer is optimistic about the recovery - and wonders why more public sector jobs weren't cut.

Democracy is an illusion! It’s become a political system fostered by the élite, for the élite, in order to fool the people that they have a stake in the system. In actual fact, they have virtually none. The whole political system in the modern era, despite having noble beginnings, is now used to benefit the few at the expense of the many. – Mark Alexander, June 29, 2018

Tuesday, 30 November 2010

SKY NEWS: On the day the OBR revised up forecasts, Sky's Jeff Randall hears what Lord Razzall and Lord Bell have to say on the UK economy. The Tory peer is optimistic about the recovery - and wonders why more public sector jobs weren't cut.

Labels:

UK economy

Monday, 29 November 2010

Saturday, 27 November 2010

SPIEGEL ONLINE: In Europa macht ein Schreckensszenario die Runde: Bricht die Euro-Union auseinander? Kehren die Länder bald zu D-Mark, Franc und Lira zurück? Die Wahrscheinlichkeit dafür ist gering, trotzdem sind Experten alarmiert. Ein Comeback der nationalen Währungen wäre fatal - vor allem für Deutschland.

Hamburg - Eigentlich gibt es sie ja noch. Die D-Mark. Sogar in Massen. Auch fast neun Jahre nach der Einführung des Euro existieren 13 Milliarden Mark - in Verstecken, Sammlungen oder Omas Sparstrumpf. Und schenkt man Umfragen Glauben, dann wünscht sich fast die Hälfte der Bundesbürger die Mark als offizielles Zahlungsmittel zurück. So haben zum Beispiel die Meinungsforscher der EU-Behörde Eurobarometer festgestellt: "Die D-Mark war für viele Deutsche das Symbol für wirtschaftliche Sicherheit, Solidität und Prosperität."

Merkmale, die Euro-Skeptiker wohl nie mit der Gemeinschaftswährung verbinden werden.

Und ist es nicht wirklich so? Hat sich Europas Finanzkrise in den vergangenen Wochen nicht dramatisch verschärft? Nach Griechenland mussten auch die Iren unter den 750 Milliarden Euro schweren Rettungsschirm schlüpfen, der ein Auseinanderbrechen der Währungsunion verhindern soll. Und schon könnten weitere Pleitekandidaten folgen. Portugal zum Beispiel, zumindest spekulieren die Finanzmärkte darauf. Im schlimmsten Fall trifft es sogar Spanien - mit dem Euro in seiner bisherigen Form wäre es dann wohl vorbei.

Doch was würde bei einem Euro-Crash eigentlich passieren? Würden in Deutschland tatsächlich die guten, alten D-Mark-Zeiten zurückkehren? Oder drohen Chaos und wirtschaftliche Depression? >>> Von Jens Witte | Samstag, 27. November 2010

Labels:

der Euro,

Deutschland,

deutschmark,

Eurozone,

Finanzkrise,

Ökonomie,

Wirtschaft

Friday, 26 November 2010

THE DAILY TELEGRAPH: Mervyn King is powerless to halt the damage to savings and spending power, says Jeremy Warner.

THE DAILY TELEGRAPH: Mervyn King is powerless to halt the damage to savings and spending power, says Jeremy Warner.Is the Bank of England trying to inflate away Britain's debts? To the untutored eye, that's certainly what it looks like. The reality is altogether less deliberate. All the same, such a perception threatens a serious assault on the Bank's credibility as an independent monetary authority, and should be taken more seriously than the somewhat irrelevant row over whether Mervyn King, the Bank's Governor, should have so wholeheartedly endorsed the Coalition's deficit reduction plans. Read on and comment >>> Jeremy Warner | Thursday, November 25, 2010

Labels:

Bank of England,

inflation,

Mervyn King

THE DAILY TELEGRAPH: The escalating debt crisis on the eurozone periphery is starting to contaminate the creditworthiness of Germany and the core states of monetary union.

THE DAILY TELEGRAPH: The escalating debt crisis on the eurozone periphery is starting to contaminate the creditworthiness of Germany and the core states of monetary union.Credit default swaps (CDS) measuring risk on German, French and Dutch bonds have surged over recent days, rising significantly above the levels of non-EMU states in Scandinavia.

"Germany cannot keep paying for bail-outs without going bankrupt itself," said Professor Wilhelm Hankel, of Frankfurt University. "This is frightening people. You cannot find a bank safe deposit box in Germany because every single one has already been taken and stuffed with gold and silver. It is like an underground Switzerland within our borders. People have terrible memories of 1948 and 1923 when they lost their savings."

The refrain was picked up this week by German finance minister Wolfgang Schäuble. "We're not swimming in money, we're drowning in debts," he told the Bundestag.

While Germany's public and private debt is not extreme, it is very high for a country on the cusp of an acute ageing crisis. Adjusted for demographics, Germany is already one of the most indebted nations in the world. Read on and comment >>> Ambrose Evans-Pritchard | Friday, November 26, 2010

Labels:

economy,

euro,

Eurozone,

financial crisis,

Germany

Wednesday, 24 November 2010

NZZ ONLINE: Der irische Ministerpräsident Brian Cowen hat die Höhe des internationalen Rettungspakets für sein Land auf voraussichtlich etwa 85 Milliarden Euro beziffert.

Über diese Summe werde verhandelt, die Zustimmung von Europäischer Union und Internationalem Währungsfonds (IWF) stehe aber noch aus, sagte Cowen am Mittwoch vor Abgeordneten in Dublin. Er bezog sich damit auf irische Medienberichte, in denen von diesem Umfang des Rettungsschirms die Rede war.

Europäischer Rekord

Wenige Stunden nach Cowens Äusserung stellte die irische Regierung ein Sparpaket mit einem Gesamtumfang von 15 Milliarden Euro vor, das Voraussetzung ist für die Hilfen von EU und IWF. Es ist die drastischste Haushaltskürzung in der Geschichte des Landes. Die Regierung will damit das Staatsdefizit bis 2014 auf die in der Eurozone geforderten drei Prozent des Bruttoinlandsprodukts senken. Die diesjährige Verschuldung Irlands beläuft sich auf einen europäischen Rekord von 32 Prozent. (+ Videos) >>> ddp | Mittwoch, 24. November 2010

Labels:

euro,

Eurozone,

Finanzkrise,

Irland,

Rettungspaket

TRIBUNE DE GENÈVE: PUBLICITÉ | L'acteur américain Bruce Willis est depuis mercredi le visage de la campagne publicitaire de la banque russe Trust, a annoncé la compagnie dans un communiqué.

TRIBUNE DE GENÈVE: PUBLICITÉ | L'acteur américain Bruce Willis est depuis mercredi le visage de la campagne publicitaire de la banque russe Trust, a annoncé la compagnie dans un communiqué.Dans cette publicité pour l'instant limitée à l'internet, le visage de l'acteur spécialiste des films d'action est accompagné d'une phrase: "Trust est comme moi, sauf que c'est une banque".

"L'image de Bruce Willis est celle d'un homme respectable, sur lequel on peut compter", relève la banque dans un communiqué, précisant s'être payé les services de l'acteur pour un an. >>> AFP | Mercredi 24 Novembre 2010

Labels:

advertising,

banking,

publicité,

Russie

Tuesday, 23 November 2010

THE GUARDIAN: Brian Cowen defies calls for resignation / Fears that Portugal and Spain may need aid / International rescue plan does little to calm markets / Datablog: how will the bailout be funded and how exposed is each economy?

Financial markets were thrown into turmoil today amid fears that an imminent collapse of Ireland's beleaguered government would have a knock-on effect across the eurozone.

The announcement of the potential €90bn international bailout for debt-laden Ireland – of which the UK could contribute up to £10bn – offered only a temporary respite to nervous markets.

By tonight, concerns that Portugal and even Spain might also need their own rescue packages were rising and sent the euro and shares falling while the risk of holding the debt of potentially vulnerable countries rose alarmingly.

After a tumultuous day in Dublin, where protesters tried to storm the parliament building, the prime minister, Brian Cowen, defied calls for his resignation but conceded he would call an election in the new year. The move was forced upon him after the Green party pulled out of his fragile coalition government, unnerving markets on a day which was supposed to restore confidence in Europe's decade-old single currency.

Instead there was a sense of growing unease in the markets amid evidence that investors felt Portugal would not survive without aid., Dealers said sentiment in the markets was reminiscent of the days after the collapse of Lehman Brothers in September 2008. Read on and comment >>> Jill Treanor, Nicholas Watt and Henry McDonald in Dublin | Monday, November 22, 2010

Sunday, 21 November 2010

WELT ONLINE: Jetzt also doch: Irland wird unter den Euro-Rettungsschirm schlüpfen. Das hochverschuldete Land braucht "mehrere zehn Milliarden Euro".

Irland wird als erstes Land offiziell um Finanzhilfe aus Mitteln des Rettungsschirms der Euroländer und des Internationalen Währungsfonds bitten. Finanzminister Brian Lenihan sagte am Sonntag im irischen Sender RTE, es gehe um „mehrere zehn Milliarden Euro“, nannte jedoch keine konkrete Summe. Griechenland hatte im Mai 110 Milliarden Euro erhalten, allerdings gab es damals den 750 Milliarden Euro umfassenden Rettungsschirm noch nicht. Er werde einen entsprechenden Vorschlag noch am Sonntag im Kabinett machen, sagte Lenihan. >>> dpa/cat | Sonntag, 21. November 2010

FRANKFURTER ALLGEMEINE ZEITUNG: Irland bittet um Hilfe: „Mehrere zehn Milliarden Euro“ >>> bes./wmu. , F.A.Z. | Sonntag, 21. November 2010

THE NEW YORK TIMES: Ireland Asks for Aid From Europe, Minister Says: DUBLIN — Ireland has formally applied for a bailout from the European Union and the International Monetary Fund, Brian Lenihan, the country’s finance minister, said Sunday. >>> Landon Thomas Jr. | Sunday, November 21, 2010

THE NEW YORK TIMES: DUBLIN — Antoinette Shields had a plan to keep her tall, blue-eyed son, Kevin, close at hand. When she took over her boss’s construction company in 2002, she hoped to retire at 55 and give her son the business.

But it is not working out that way. Mrs. Shields’s company, which once employed 26 people, is now down to 8, still afloat in Ireland’s collapsed economy, but barely. Though Kevin graduated from college two weeks ago, she has no work for him, and he expects to emigrate to the United States or Canada next year.

“That is where we are,” Mrs. Shields said. “Sad, isn’t it?”

Just three years ago as Ireland’s economy boomed, immigrants poured in so fast that experts said this tiny country of 4.5 million was on its way to reaching population levels not seen since before the great potato famine of the mid-19th century. The conditions that prompted the Irish statesman Éamon de Valera to express the hope that Ireland’s children would no longer “like our cattle, be brought up for export” seemed like quaint history.

That has abruptly turned around. >>> Suzanne Daley | Saturday, November 20, 2010

THE TIMES: Ireland goes cap in hand to IMF >>> Sadie Gray | Sunday, November 21, 2010 | (Behind a paywall: £)

THE SUNDAY TIMES: Who killed the Celtic tiger? >>> James Ashton and Iain Dey | Sunday, November 21, 2010 | (Behind a paywall: £)

THE SUNDAY TIMES: Death of the euro >>> David Smith and Richard Woods | Sunday, November 21, 2010 | (Behind a paywall: £)

Labels:

Celtic Tiger,

der Euro,

EU,

Eurozone,

Finanzkrise,

IMF,

Ireland,

Irland

Thursday, 18 November 2010

Had It So Good

THE DAILY TELEGRAPH: The vast majority of Britons have "never had it so good" because of the low interest rates during the recession, Lord Young, a senior adviser to David Cameron, has declared.

Lord Young, the Prime Minister's enterprise adviser, said a drop in mortgage rates "since this so-called recession" had left most people better off. Speaking to The Daily Telegraph, the Conservative peer also said "people will wonder what all the fuss was about" when looking back at the Government's spending cuts, the deepest in more than 30 years.

He described the loss of about 100,000 public-sector jobs a year as being within "the margin of error" in the context of the 30 million-strong job market as a whole.

The remarks are likely to prove inflammatory after the worst recession in a generation which has led to a sharp rise in unemployment and resulted in millions of workers forced to accept a pay freeze.

Critics of the Coalition will seize on the comments to claim that ministers are out of touch with the impact of government cutbacks on poorer families. >>> Chistopher Hope, and Robert Winnett | Thursday, November 18, 2010

Where did they find this little fossil? It sounds to me that he is suffering from softening of the brain! People have never had it so good? What on earth is the idiot talking about? Try telling that to a man who has to feed his family. This man is living in cloud cuckoo land. – © Mark

Lord Young forced to apologise >>>

The Coalition has never had it so good, more like! >>>

And Nick Clegg’s wife’s law firm seems never to have had it so good, either! >>>

Labels:

conservatives,

financial crisis

Wednesday, 17 November 2010

THE DAILY TELEGRAPH: The crisis in the eurozone shows why this country must widen its horizons, writes Simon Heffer.

On a shimmering day last June, I was talking to one of our most intelligent diplomats about the future of the euro. He told me, matter-of-factly, that there would be a serious crisis again before Christmas, and he suggested that it might not even survive in its present form. He has been proved right about the first point. Whether he is right about the second is anyone's guess, but if the markets have their way, he will be.

Privately, those who understand the workings of the European Union, but who can manufacture the right amount of detachment about them, admit that the iron façade of common purpose in the European project is starting to creak and rust. For years, a series of pretences has been entered into by dreamers of the European dream about the union's ability to advance as one entity. It has become worse since the inception of the single currency, of which this country is not, thank heaven, a member.

The club pretends (or sought to pretend: it is now wearing a bit thin) that the great disparities between, say, an economy like Germany's and one like Ireland's or Portugal's could be accommodated within the same common policy; and could be so while individual countries were allowed a measure of economic sovereignty, such as setting their own tax rates. Technically, deficits were to be regulated, but in practice, and in the interests of not upsetting any applecarts, they were not: otherwise, France and Italy would have been booted out long ago. The result is that some countries are now threatening to break the system. And poor old Ireland, with a number of its state-owned banks facing oblivion, cannot even turn its economy around, despite heroic amounts of self-flagellation. But then, if you were trying to have an export-led recovery when your goods were denominated in a currency that is among the most expensive in the world, you would be suffering, too. Read on and comment >>> Simon Heffer | Tuesday, November 16, 2010

SKY NEWS: Banking giant HSBC is doubling the basic pay of hundreds of its senior investment bankers, Sky News can reveal.

Sky's City editor Mark Kleinman reports that the bank began informing staff in London, Hong Kong and New York about the pay rises last week.

A source close to the bank said some senior managers outside the global banking and markets (GBM) division were also being handed the pay increases.

HSBC's move comes ahead of the annual bank bonus round in the New Year.

"As UK politicians intensify warnings about the payment of mega-bonuses, HSBC may legitimately be able to point to a sharply reduced bonus pot by virtue of the fact that it will have only recently awarded large salary increases," noted Kleinman. Read on and comment >>> Hazel Baker, Sky News Online | Tuesday, November 16, 2010

Labels:

bonuses,

greed,

investment banking,

salaries

THE DAILY TELEGRAPH: The eurozone bail-out for Greece has begun to unravel after Austria suspended aid contributions over failure to comply with the rescue terms, and Germany warned Athens that its patience was running out.

The clash caught markets off-guard and heightened fears that Europe's debt crisis may be escalating, with deep confusion over the Irish crisis as Dublin continues to resist EU pressure to request its own rescue.

Olli Rehn, the EU economics commissioner, said escalating rhetoric in Europe was turning dangerous. "I want to call on every responsible European to resist the centrifugal tendencies and existential alarmism."

Swirling rumours hit eurozone bond markets, while bourses tumbled across the world. The FTSE 100 fell 2.4pc to 5681.9, and the Dow dropped over 200 points in early trading. The euro slid two cents to $1.3460 against the dollar as the US currency regained its safe-haven status. Read on and comment >>> Ambrose Evans-Pritchard | Tuesday, November 16, 2010

TELEGRAPH BLOGS – JEREMY WARNER: Austria Tells Greece to Get Stuffed: Europe’s hastily assembled bailout fund already seems to be coming apart at the seams, and that’s before Ireland has even tapped into it. Austria is refusing to contribute to the next tranche of bailout money for Greece, citing the country’s failure to meet conditions. Yesterday it emerged there is serious slippage in Greece’s deficit reduction programme. >>> Jeremy Warner | Tuesday, November 16, 2010

Tuesday, 16 November 2010

LE POINT: La zone euro et l'Union européenne tout entière avec elle ne "survivront pas" si les problèmes budgétaires actuels de certains pays ne sont pas résolus, a mis en garde mardi le président de l'UE, Herman Van Rompuy. "Nous sommes confrontés à une crise pour notre survie", a-t-il déclaré lors d'une intervention devant un centre de réflexion bruxellois, l'European Policy Center. "Nous devons tous travailler de concert afin de permettre à la zone euro de survivre. Car si la zone euro ne survit pas, l'Union européenne ne survivra pas non plus", a-t-il ajouté. "Mais j'ai confiance dans le fait que nous allons surmonter cela", a-t-il ajouté. >>> Source AFP | Mardi 16 Novembre 2010

TELEGRAPH BLOGS – AMBROSE EVANS-PRITCHARD: The entire European Project is now at risk of disintegration, with strategic and economic consequences that are very hard to predict.

In a speech this morning, EU President Herman Van Rompuy (poet, and writer of Japanese and Latin verse) warned that if Europe’s leaders mishandle the current crisis and allow the eurozone to break up, they will destroy [the] European Union itself.

“We’re in a survival crisis. We all have to work together in order to survive with the euro zone, because if we don’t survive with the euro zone we will not survive with the European Union,” he said.

Well, well. This theme is all too familiar to readers of The Daily Telegraph, but it comes as something of a shock to hear such a confession after all these years from Europe’s president.

He is admitting that the gamble of launching a premature and dysfunctional currency without a central treasury, or debt union, or economic government, to back it up – and before the economies, legal systems, wage bargaining practices, productivity growth, and interest rate sensitivity, of North and South Europe had come anywhere near sustainable convergence – may now backfire horribly.

Jacques Delors and fellow fathers of EMU were told by Commission economists in the early 1990s that this reckless adventure could not work as constructed, and would lead to a traumatic crisis. They shrugged off the warnings. Read on and comment >>> Ambrose Evans-Pritchard | Tuesday, November 16, 2010

Labels:

euro,

European Union,

Eurozone,

monetary union

THE NEW YORK TIMES: LONDON — European officials, increasingly concerned that the Continent’s debt crisis will spread, are warning that any new rescue plans may need to cover Portugal as well as Ireland to contain the problem they tried to resolve six months ago.

Any such plan would have to be preceded by a formal request for assistance from each country before it would be put in place. And for months now, Ireland has insisted that it has enough funds to keep it going until spring. Portugal says it, too, needs no help and emphasizes that it is in a stronger position than Ireland.

While some important details are different, the current situation feels eerily similar to what happened months ago in Greece, where the cost of borrowing rose precipitously.

European authorities stepped in with a rescue package, expecting an economic recovery and the creation of new European rescue funds to fend off future panics by bond investors whose money is needed by countries to refinance their debt.

But with economic conditions weakening, markets are once again in turmoil. Rescuing Ireland may no longer be enough.

Stronger countries and weaker countries using the common currency of the euro are being pulled in different directions.

Some economists wonder if unity will hold or if some new system that allows countries to move on one of two parallel financial tracks is needed. Read on and comment >>> Landon Thomas Jnr and James Kanter | Monday, November 15, 2010

WELT ONLINE: Deutschland wird zum Zahlmeister der Eurozone: Ein Ausstieg aus dem Euro kommt für die Kanzlerin nicht infrage. Jetzt wetten die Finanzmärkte auf eine Transferunion. Das wird teuer. >>> Autor: D. Eckert und H. Zschäpitz | Dienstag, 16. November 2010

THE DAILY TELEGRAPH: The euro is facing an unprecedented crisis after another country indicated that it was at a “high risk” of requiring an international bail-out.

Portugal became the latest European nation to suggest it was on the brink of seeking help from Brussels after Ireland confirmed it had begun preliminary talks over its debt problems.

Greece also disclosed yesterday that its economic problems are even worse than previously thought. Last night, the German Chancellor Angela Merkel raised the spectre of the euro collapsing as she warned: “If the euro fails, then Europe fails.” >>> Bruno Waterfield in Brussels and Robert Winnett | Monday, November 15, 2010

THE GUARDIAN: Investors pressure Brussels for solution but Irish officials deny any need for bailout

The Irish debt crisis intensified today, after other high-deficit countries such as Portugal warned about a possible contagion effect, and investors pressured European officials to come up with a solution to calm markets. Irish officials reiterated that they don't need any bail-out.

The crisis moved from trading rooms into the political arena, as European finance ministers are meeting tomorrow and the day after in Brussels. Investors expect them to announce a resolution, or at least to shed some clarity about how much money they would lose were any European country to default.

"The Irish problem is already spreading, but it could get more violent and volatile," said Ashok Shah, chief investment officer at London Capital, a fund management firm. "They have to get this bail-out, they have a period of time before it gets impossible, before nasty things happen. The longer they leave it, the more difficult it will get."

Pressure on the EU escalated after Portugal's finance minister Fernando Teixeira dos Santos said his country was at risk of a possible contagion, as "we are not facing only a national or country problem - it is the problems of Greece, Portugal and Ireland," he said. >>> Elena Moya | Monday, November 15, 2010

Monday, 15 November 2010

THE DAILY TELEGRAPH: Portugal has admitted that it could become the latest European Union country to seek a bail-out as the eurozone debt crisis deepened.

Fernando Teixeira dos Santos, the Portuguese Finance Minister, has warned that the fall out from concerns over Ireland's public finances could create a contagion effect among its neighbours.

"The risk is high because we are not facing only a national or country problem," he told Dow Jones news wires, in reference to the possibility that Lisbon will need international financial assistance.

“It is the problems of Greece, Portugal and Ireland. This is not a problem of only this country. This has to do with the euro zone and the stability of the eurozone, and that is why contagion in this framework is more likely. >>> Andrew Hough, Bruno Waterfield in Brussels, Robert Winnett and Heidi Blake | Monday, November 15, 2010

THE SUNDAY TELEGRAPH: Europe stumbles blindly towards its 1931 moment: It is the European Central Bank that should be printing money on a mass scale to purchase government debt, not the US Federal Reserve. >>> Ambrose Evans-Pritchard | Sunday, November 14, 2010

Saturday, 13 November 2010

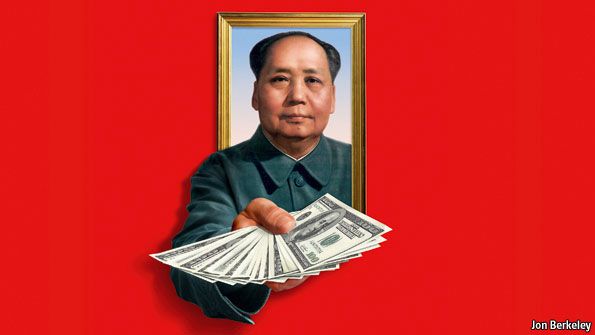

THE ECONOMIST: And the world should stay open for business

IN THEORY, the ownership of a business in a capitalist economy is irrelevant. In practice, it is often controversial. From Japanese firms’ wave of purchases in America in the 1980s and Vodafone’s takeover of Germany’s Mannesmann in 2000 to the more recent antics of private-equity firms, acquisitions have often prompted bouts of national angst.

Such concerns are likely to intensify over the next few years, for China’s state-owned firms are on a shopping spree. Chinese buyers—mostly opaque, often run by the Communist Party and sometimes driven by politics as well as profit—have accounted for a tenth of cross-border deals by value this year, bidding for everything from American gas and Brazilian electricity grids to a Swedish car company, Volvo.

There is, understandably, rising opposition to this trend. The notion that capitalists should allow communists to buy their companies is, some argue, taking economic liberalism to an absurd extreme. But that is just what they should do, for the spread of Chinese capital should bring benefits to its recipients, and the world as a whole.

Why China is different

Not so long ago, government-controlled companies were regarded as half-formed creatures destined for full privatisation. But a combination of factors—huge savings in the emerging world, oil wealth and a loss of confidence in the free-market model—has led to a resurgence of state capitalism. About a fifth of global stockmarket value now sits in such firms, more than twice the level ten years ago.

The rich world has tolerated the rise of mercantilist economies before: think of South Korea’s state-led development or Singapore’s state-controlled firms, which are active acquirers abroad. Yet China is different. It is already the world’s second-biggest economy, and in time is likely to overtake America. Its firms are giants that until now have been inward-looking but are starting to use their vast resources abroad. >>> | Thursday, November 11, 2010

Tosh from ‘The Economist’! – © Mark

Labels:

acquisitions,

China

THE NEW YORK TIMES: SEOUL, South Korea — President Obama’s hopes of emerging from his Asia trip with the twin victories of a free trade agreement with South Korea and a unified approach to spurring economic growth around the world ran into resistance on all fronts on Thursday, putting Mr. Obama at odds with his key allies and largest trading partners.

The most concrete trophy expected to emerge from the trip eluded his grasp: a long-delayed free trade agreement with South Korea, first negotiated by the Bush administration and then reopened by Mr. Obama, to have greater protections for American workers.

And as officials frenetically tried to paper over differences among the Group of 20 members with a vaguely worded communiqué to be issued Friday, there was no way to avoid discussion of the fundamental differences of economic strategy. After five largely harmonious meetings in the past two years to deal with the most severe downturn since the Depression, major disputes broke out between Washington and China, Britain, Germany and Brazil.

Each rejected core elements of Mr. Obama’s strategy of stimulating growth before focusing on deficit reduction. Several major nations continued to accuse the Federal Reserve of deliberately devaluing the dollar last week in an effort to put the costs of America’s competitive troubles on trading partners, rather than taking politically tough measures to rein in spending at home.

The result was that Mr. Obama repeatedly found himself on the defensive. He and the South Korean president, Lee Myung-bak, had vowed to complete the trade pact by the time they met here; while Mr. Obama insisted that it would be resolved “in a matter of weeks,” without the pressure of a summit meeting it was unclear how the hurdles on nontariff barriers to American cars and beef would be resolved. >>> Sewell Chan, Sheryl Gay Stolberg and David E. Sanger | Thursday, November 11, 2010

THE NEW YORK TIMES: Obama Ends G-20 Summit With Criticism of China >>> Sewell Chan | Friday, November 12, 2010

THE TELEGRAPH: China believes its economic success reflects its superior culture.

The leaders of the G20 group of rich and developing nations met in Seoul this week for what might reasonably be described as their first post-crisis summit. But it also had the feeling of the first post-Western summit. China, the world’s second richest nation and its rising power, believes that the financial crisis was actually a “North Atlantic crisis”. Now that the worst of it is over, Beijing sees little reason to swallow the medicine for someone else’s sickness. The summit therefore broke up – none too amicably – without really addressing the trade imbalances that were one of the root causes of the crisis, or America’s worry that Beijing is gaining an unfair advantage by artificially keeping its currency weak. Instead, China flexed its muscles and got what it wanted: a watered-down statement that will not force it to change course. If President Obama hoped that the G20 would burnish his image as a world statesman after the disaster of the midterm elections, those hopes were disappointed.

It is inescapable that we are witnessing a historic shift of economic power from West to East. David Cameron has certainly taken this on board, judging by the caution with which he and his Cabinet members treated China during their visit earlier this week. The Prime Minister approached the subject of human rights far more obliquely than he did as leader of the Opposition. Whether this was wise judgment or a failure of nerve is difficult to say. Although China treats dissidents with gross inhumanity, the more it is lectured on the subject, the more intransigent it becomes. In a sense, that is convenient for Mr Cameron: if protesting about repression makes the situation worse, then Britain can concentrate on trade with a fairly clear conscience. Read on and comment >>> Telegraph View | Friday, November 12, 2010

Labels:

Angela Merkel,

Barack Obama,

Brazil,

China,

G20,

global economy,

Seoul,

South Korea,

United Kingdom

Friday, 12 November 2010

FRANKFURTER ALLGEMEINE ZEITUNG: Seit Monaten machen sich Anleger Sorgen um die finanzielle Stabilität Irlands. Jetzt haben die fünf größten EU-Staaten versucht, die Gläubiger Irlands und anderer finanzschwacher Euro-Staaten zu beruhigen: Der gegenwärtige Rettungsschirm beteilige private Investoren nicht an den Kosten einer Rettungsaktion.

Führende Politiker großer Staaten der Europäischen Union haben am Freitag die Gläubiger der finanzschwachen Euro-Staaten beruhigt. Die Finanzminister Deutschlands, Frankreichs, Großbritanniens, Spaniens und Italiens teilten gemeinsamen mit, dass der gegenwärtige europäische Rettungsschirm private Investoren nicht an den Kosten beteilige. Ein Mechanismus, der auch die Gläubiger heranziehen könnte, wenn ein Land in Zahlungsschwierigkeiten gerate, werde nicht vor Mitte 2013 in Kraft treten. Bis dahin gelte der im Sommer beschlossene europäische Rettungsschirm. >>> Von Carsten Germis, Manfred Schäfers und Stefan Ruhkamp | Freitag, 12. November 2010

Labels:

Finanzkrise,

Irland

Thursday, 11 November 2010

THE DAILY TELEGRAPH: Premium Bonds are enormously popular, but do they offer decent returns?

Britain's 250th Premium Bond millionaire was created this month. The lucky winner is from the East Riding of Yorkshire – one of 132,118 Premium Bonds held in the East Riding district alone.

There are 23 million Premium Bond holders in the UK, making it the most popular savings product in Britain. More than a third of us hold at least one of the nation's first examples of government-sponsored gambling.

The Premium Bond scheme – often known as Ernie – is run by the Government's savings arm, National Savings & Investments (NS&I), and were launched by Harold Macmillan in his Budget in 1956 as a way of reducing inflation and to encourage saving after the end of the Second World War.

The idea was aimed at those who were more interested in winning a prize than getting regular interest payments. The Opposition called it a "squalid raffle", but the country disagreed.

On the first day, £5m of Premium Bonds were sold, and by the time the first draw took place on June 1 1957, £82m had been invested, with a top prize of £1,000 paid. In all, 23,000 prizes were awarded.

A single £1m prize is awarded each month, although to celebrate the bonds' 50th anniversary, NS & I paid out five £1m jackpots in December 2006 and June 2007. In 1994, there was £4bn invested in Premium Bonds, but that has risen to £41bn today.

Sally Swait, Premium Bonds manager at NS&I, said: "We wanted to recognise these landmark dates by holding our biggest ever prize draws."

Each Premium Bond costs £1 and the most you can invest is £30,000. While there is no interest paid, you are entered into a draw with the chance to win £1m every month. The chances of winning ''the big one'' are slim at 24,000 to one, but the chances of winning the National Lottery are about 14m to one, so the odds could be a lot worse. Read on and comment >>> Alison Steed | Tuesday, November 09, 2010

Labels:

Ernie,

Premium Bonds

FRANKFURTER ALLGEMEINE ZEITUNG: Barack Obama hat in Seoul einen schweren Stand. China, Deutschland, aber auch Brasilien sind - gelinde gesagt - über die amerikanische Wirtschafts- und Finanzpolitik verstimmt. Das Anwerfen der Notenpresse in den Vereinigten Staaten weckt Ängste vor Inflation und Spekulation.

FRANKFURTER ALLGEMEINE ZEITUNG: Barack Obama hat in Seoul einen schweren Stand. China, Deutschland, aber auch Brasilien sind - gelinde gesagt - über die amerikanische Wirtschafts- und Finanzpolitik verstimmt. Das Anwerfen der Notenpresse in den Vereinigten Staaten weckt Ängste vor Inflation und Spekulation.Beim Gipfel der führenden Wirtschaftsmächte (G20) stehen die Vereinigten Staaten im Abseits. Das Anwerfen der Notenpresse durch die amerikanische Notenbank und die Idee einer „Exportbremse“ für Deutschland und China stießen schon vor Beginn des Treffens in der südkoreanischen Hauptstadt Seoul auf massive Kritik. Die G-20-Staats- und Regierungschefs wollen bis Freitag versuchen, einen „Währungskrieg“ und neue Schranken im Welthandel zu verhindern.

Bundeskanzlerin Angela Merkel (CDU) erteilte dem Vorschlag von Barack Obama eine klare Absage, führende Exportnationen müssten ihren Handelsüberschuss deckeln und stattdessen mehr für die heimische Nachfrage tun: „Eine politische Festlegung von Obergrenzen für Leistungsbilanzüberschüsse oder -defizite ist weder ökonomisch gerechtfertigt noch politisch angemessen“, sagte sie bei einem G20- „Business Summit“ vor 100 Topmanagern aus aller Welt. „Dies wäre unvereinbar mit dem Ziel eines freien Welthandels.“ >>> dpa | Donnerstag, 11. November 2010

Labels:

G20,

Seoul,

Südkorea,

US Finanzpolitik

THE GUARDIAN: Work and pensions secretary prepares to introduce the most severe welfare sanctions ever imposed by a British government

Ian Duncan Smith, the work and pensions secretary, said today it was a "sin" that people failed to take up available jobs as he prepared to announce a tougher-than-expected squeeze on the unemployed.

This will see the jobless face the threat of losing all benefits for as long as three years if they refuse community work or the offer of a job, or fail to apply for a post if advised to do so.

In the most severe welfare sanctions ever imposed by a British government, unemployed people will lose benefits for three months if they fail to take up one of the options for the first time, six months if they refuse an offer twice, and three years if they refuse an offer three times.

Downing Street sources said the new "claimant contract" will come into force as soon as legislation is passed, and may not wait for the introduction of a streamlined universal credit system in 2013-14.

Duncan Smith will tell MPs today that he is introducing the biggest shake-up of the welfare system since the Beveridge reforms ushered in the welfare state after the second world war. He will say that a new universal credit system will make 2.5 million of the poorest people better off and reduce the number of workless households by 300,000. Read on and comment >>> Patrick Wintour, Randeep Ramesh and Hélène Mulholland | Thursday, November 11, 2010

Labels:

unemployment,

welfare benefits

Wednesday, 10 November 2010

THE DAILY TELEGRAPH – BLOGS – JEREMY WARNER: Here’s a finding that will have any red-blooded American spluttering into his cornflakes. According to the Conference Board, a highly respected economic research association, China will overtake the US as the world’s biggest economy by 2012, or within two years. Read on and comment >>> Jeremy Warner | Wednesday, November 10, 2010

Labels:

China economy,

US economy

Sunday, 7 November 2010

THE DAILY TELEGRAPH: The struggle to curtail the social democratic state could have ugly consequences, says Janet Daley.

There seems to be only one political argument of interest left in the Western democracies: how “big” should the state be, and what are the proper limits of its responsibilities? Abstract as it may sound, this question has had a quite startling impact on the everyday experience – and voting habits – of people in the most advanced countries of the world.

In the United States, the electorate’s considered answer to it has humiliated a president and swept an extraordinary number of neophytes – whose primary attraction was their loathing of government power – into the most powerful legislature in history. In Britain, it has become the dominant theme (in fact, the raison d’être) of a coalition between a Left-of-centre party and a Right-of-centre one, which has managed to achieve a remarkable degree of agreement on the need to reduce – or, at least, to examine rigorously – the role of government intervention in all areas of social life.

The dominant economies of Europe, too, are going through quite momentous re-examinations of the post-war philosophy which accepted the state as an unquestionable source of benevolence and all-pervasive social justice. And this massive reassessment of the role of government has not come about simply because of the economic crisis, and the terrifying degree of sovereign debt which it produced. The governments of what were the richest countries in the world may be broke, but what is interesting is their response to this: the plan is not to make themselves rich enough once again to do all the things that they used to do, but to rethink the whole enterprise so that government never again finds itself so extravagantly overextended.

On this side of the Atlantic, there is now a broad understanding that the social democratic project itself is unsustainable: that it has grown wildly beyond the principles of its inception and that the consequences of this are not only unaffordable, but positively damaging to national life and character. The US, bizarrely, is running at least 10 years behind in this process, having elected a government which chose to embark on the social democratic experiment at precisely the moment when its Western European inventors were despairing of it, and desperately trying to find politically palatable ways of winding it down.

The American people – being made of rather different stuff and having historical roots which incline them to be distrustful of government in any form – immediately rejected the whole idea. But in Britain, too, among real people (as opposed to ideological androids) there is a general sense that governments – even when they are elected by a mass franchise – become out of touch and out of control, and that something essential to human dignity and potential is under threat from their overweening interference. Read on and comment >>> Janet Daley | Saturday, November 06, 2010

Labels:

big government,

Janet Daley

Friday, 5 November 2010

LE TEMPS: La décision de la Réserve Fédérale d’injecter 600 milliards de dollars dans l’économie redonne des couleurs aux marchés boursiers mondiaux. Ces derniers ont accueilli jeudi la nouvelle en gagnant 2,4%. Wall Street retrouve des niveaux inédits depuis l’effondrement de la banque Lehman Brothers en septembre 2008

La Bourse de New York a fini en nette hausse jeudi soir. Wall Street a été portée à des sommets inédits depuis la chute de Lehman Brothers en 2008 par l’annonce de nouvelles mesures de relance aux Etats-Unis: le Dow Jones a gagné pratiquement 2% sur la journée. À 11 434,84 points, l’indice phare du marché boursier américain revient ainsi à son niveau du 11 septembre 2008. Cette journée avait précédé l’effondrement de la banque new-yorkaise qui avait déclenché une panique financière. Sur la journée de jeudi, l’ensemble des marchés boursiers mondiaux a, en moyenne, grimpé de 2,4%. Le marché obligataire a profité des annonces de la Fed. Le rendement exigé par les marchés sur les emprunts à 10 ans du Trésor américain a baissé à 2,5%, tandis que celui des emprunts à 30 ans s’est tassé à 4,04%. Les milieux financiers attendent aujourd’hui le troisième grand rendez-vous de la semaine, après les élections et la Fed: les chiffres mensuels de l’emploi. >>> AFP and Bloomberg | Vendredi 05 Novembre 2010

Labels:

Wall Street

THE DAILY TELEGRAPH: Currency competition is the only way to fix the world economy, says Jeremy Warner.

Right from the start of the financial crisis, it was apparent that one of its biggest long-term casualties would be the mighty dollar, and with it, very possibly, American economic hegemony. The process would take time – possibly a decade or more – but the starting gun had been fired.

At next week's meeting in Seoul of the G20's leaders, there will be no last rites – this hopelessly unwieldy exercise in global government wouldn't recognise a corpse if stood before it in a coffin – but it seems clear that this tragedy is already approaching its denouement.

To understand why, you have to go back to the origins of the credit crunch, which lay in the giant trade and capital imbalances that have long ruled the world economy. Over the past 20 years, the globe has become divided in highly dangerous ways into surplus and deficit nations: those that produced a surplus of goods and savings, and those that borrowed the savings to buy the goods.

It's a strange, Alice in Wonderland world that sees one of the planet's richest economies borrowing from one of the poorest to pay for goods way beyond the reach of the people actually producing them. But that process, in effect, came to define the relationship between America and China. The resulting credit-fuelled glut in productive capacity was almost bound to end in a corrective global recession, even without the unsustainable real-estate bubble that the excess of savings also produced. And sure enough, that's exactly what happened.

When politicians see a problem, especially one on this scale, they feel obliged to regulate it. But so far, they've been unable to make headway. This is mainly because the surplus nations are jealous defenders of their essentially mercantilist economic models. Exporting to the deficit nations has served them well, and they are reluctant to change. >>> Jeremy Warner | Friday, November 05, 2010

THE DAILY TELEGRAPH: Doubts grow over wisdom of Ben Bernanke 'super-put': The early verdict is in on the US Federal Reserve's $600bn of fresh money through quantitative easing. Yields on 30-year Treasury bonds jumped 20 basis points to 4.07pc. >>> Ambrose Evans-Pritchard, International Business Editor | Thursday, November 04, 2010

Labels:

US dollar hegemony

WELT ONLINE: Die US-Notenbank will die Wirtschaft mit der Notenpresse ankurbeln. Finanzminister Schäuble übt daran nun ungewöhnlich scharfe Kritik.

Bundesfinanzminister Wolfgang Schäuble (CDU) hat die jüngste Maßnahme der US-Notenbank zur Ankurbelung der Wirtschaft als Bruch internationaler Abmachungen kritisiert. Die großen Wirtschaftsprobleme der USA seien mit noch mehr Schulden nicht zu lösen, sagte Schäuble am Donnerstagabend den ARD-„Tagesthemen“. „Das war übrigens gemeinsame Politik, der sich noch alle Industrieländer, auch die USA, beim G-20-Gipfel in Toronto (...) ausdrücklich verpflichtet haben.“

US-Notenbankchef Ben Bernanke verteidigte dagegen den geldpolitischen Kurs der Federal Reserve. Die US-Notenbank hatte verkündet, Staatsanleihen für 600 Milliarden Dollar zu kaufen. Nach den Worten Schäubles bereiten die USA der internationalen Finanzwelt damit zusätzliche Probleme. Experten fürchten eine ausufernde Inflation sowie eine Verschärfung der weltweiten Währungsungleichgewichte.

„Wir werden das auch in bilateralen Gesprächen, aber natürlich auch beim G-20-Gipfel in der kommenden Woche in Südkorea mit unseren amerikanischen Freunden kritisch ansprechen“, kündigte der Minister an. Die USA wollen mit dem umstrittenen Manöver die Kreditzinsen senken, um auf diese Weise die schleppende Nachfrage anzukurbeln. Die neue Milliardenstütze der US-Notenbank lässt Europas Währungshüter kalt. EZB-Präsident Jean-Claude Trichet stellte am Donnerstag klar, dass die Europäische Zentralbank (EZB) an ihrem Kurs festhält und den Geldhahn allmählich zudrehen wird. >>> dpa/tma | Freitag, 05. November 2010

Thursday, 4 November 2010

MAIL ONLINE: Antonio Horta-Osorio has been named the new chief executive of taxpayer-backed Lloyds bank.

MAIL ONLINE: Antonio Horta-Osorio has been named the new chief executive of taxpayer-backed Lloyds bank.Mr Horta Osorio, the current UK boss of Santander, will join early next year when he takes over from current chief Eric Daniels, who is due to retire.

However the arrival package he will receive on his appointment has provoked outrage as he could scoop up to a whopping £8.3million in the first year alone.

His package includes a basic salary of just over £1million, but he could collect another £2.3million in annual bonuses plus around £4.3million in long term share awards.

In addition he will pay £610,000 in pension payments, meaning his total package could added up to £8.3million. >>> Daily Mail Reporter | Wednesday, November 03, 2010

Labels:

Banco Santander,

banking,

huge bonuses,

Lloyds TSB

Wednesday, 3 November 2010

DIE PRESSE: Die Fed kauft Staatsanleihen im Wert von 600 Milliarden Dollar, um den Arbeitsmarkt zu beleben. Weitere Wertpapierkäufe schließt die Leitung der US-Notenbank nicht aus. Experten befürchten bereits eine Deflation.

Alle Augen waren auf Ben Bernanke gerichtet. Am Mittwochabend gab der Chef der US-Notenbank Fed schließlich bekannt, worüber seit Tagen spekuliert worden war: Die Fed wird den Geldhahn erneut aufdrehen. Bis Mitte 2011 will die US-Zentralbank Staatsanleihen im Wert von 600 Milliarden Dollar (umgerechnet rund 428 Milliarden Euro) kaufen. Zusätzlich sollen Papiere, die bereits der Fed gehören, aber auslaufen, durch neue ersetzt werden. Damit belaufen sich die Anleihenkäufe in Summe auf 850 bis 900 Milliarden Dollar. >>> Wien/Reuters/Dj | Mittwoch, 03. November 2010

NZZ ONLINE: Fed druckt mehr Geld: 900 Milliarden Dollar für Aufkauf von Staatspapieren >>> sda/Reuters | Mittwoch, 03. November 2010

Labels:

US-Notenbankpolitik

THE WALL STREET JOURNAL: While housing markets in the rest of the world crumbled, Australia's market stayed robust. Critics, however, warn of a housing bust. WSJ's Geoffrey Rogow went to Sydney's Property Expo to find out what average Australians think of the debate.

Labels:

Australia,

housing market

THE WALL STREET JOURNAL: Arianna Huffington tells WSJ's Jerry Seib and Alan Murray that the Obama Administration's big flaw was to underestimate the extent of the economic devastation on Main Street. The answer to a solution, she says, is to stop seeing everything as a left/right division.

Tuesday, 2 November 2010

THE DAILY TELEGRAPH: Saudi Arabia's top clerics have challenged the government's policy to expand jobs for women with a fatwa ruling that they should not work as cashiers in supermarkets, according to reports.

The Council of Senior Scholars, the official fatwa issuing body, said that "it is not permissible for a woman to work in a place where they mix with men," the news website Sabq.org said.

"It is necessary to keep away from places where men congregate. Women should look for decent work that does not make it possible for them to attract men or be attracted by men," it said. >>> | Monday, November 01, 2010

Labels:

Saudi Arabia,

working women

THE DAILY TELEGRAPH: The Saudi Arabian energy minister pushed up oil futures by $2 per barrel, after implying the powerful nation will not do anything to stop prices rising to $90.

The comments will drive further fears of inflation, as transportation costs of consumer goods tends to rise with the oil price.

Brent crude rose $2.06 to $85.21, as any signs about Saudi Arabia's plans for output can have a huge impact on the volatile oil market.

Ali al-Naimi, the oil minister, told a conference in Singapore: "Consumers are looking for oil prices around $70, but hopefully less than $90. There's almost an anchor now for the price."

Analysts quickly pointed out that this $70-$90 range is higher than the previous $70-$80 window cited by the Gulf nation as comfortable. Read on and comment >>> Rowena Mason | Monday, November 01, 2010

THE DAILY TELEGRAPH: As the US Federal Reserve meets today to decide whether its next blast of quantitative easing should be $1 trillion or a more cautious $500bn, it does so knowing that China and the emerging world view the policy as an attempt to drive down the dollar.

The Fed's "QE2" risks accelerating the demise of the dollar-based currency system, perhaps leading to an unstable tripod with the euro and yuan, or a hybrid gold standard, or a multi-metal "bancor" along lines proposed by John Maynard Keynes in the 1940s.

China's commerce ministry fired an irate broadside against Washington on Monday. "The continued and drastic US dollar depreciation recently has led countries including Japan, South Korea, and Thailand to intervene in the currency market, intensifying a 'currency war'. In the mid-term, the US dollar will continue to weaken and gaming between major currencies will escalate," it said.

David Bloom, currency chief at HSBC, said the root problem is lack of underlying demand in the global economy, leaving Western economies trapped near stalling speed. "There are no policy levers left. Countries are having to tighten fiscal policy, and interest rates are already near zero. The last resort is a weaker currency, so everybody is trying to do it," he said.

Pious words from G20 summit of finance ministers last month calling for the world to "refrain" from pursuing trade advantage through devaluation seem most honoured in the breach.

Taiwan intervened on Monday to cap the rise of its currency, while Korea's central bank chief said his country is eyeing capital controls as part of its "toolkit" to stem the flood of Fed-created money leaking out of the US and sloshing into Asia. Brazil has just imposed a 2pc tax on inflows into both bonds and equities – understandably, since the real has risen by 35pc against the dollar this year and the country has a current account deficit.

"It is becoming harder to mop up the liquidity flowing into these countries," said Neil Mellor, of the Bank of New York Mellon. "We fully expect more central banks to impose capital controls over the next couple of months. That is the world we live in," he said. Globalisation is unravelling before our eyes. Read on and comment >>> Ambrose Evans-Pritchard, International Business Editor | Monday, November 01, 2010

Subscribe to:

Posts (Atom)