‘We Have to Help the Greeks,’ Say French, ‘It’s Our Duty’

‘We Have to Help the Greeks,’ Say French, ‘It’s Our Duty’TIMES ONLINE: It is a gloriously sunny

Pentecôte bank holiday, and hundreds of people have descended on Morschwiller-le-Bas, a suburb of the French city of Mulhouse, for its annual

marché aux puces — flea market.

The eurozone crisis is hardly uppermost in their minds as they pick through the mounds of second-hand clothes and bric-a-brac, but they respond when asked, and their views could scarcely be more different from those we found in Germany, a mere 15km (9 miles) to the east.

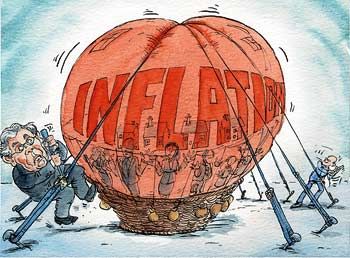

The hard-working Germans were furious at the €148 billion euros (£126.1 billion) in loan guarantees that their Government has offered the Greeks and other states of the southern eurozone. Here in France, nobody even knows how much their Government has put up (the answer is €111 billion) and there has been scarcely a murmur of dissent.

“If we consider Europe a serious matter we have to help the Greeks,” said Jacqueline Wertz, a retired hotel worker eating pizza in the shade. “They have to have more discipline, but we have a duty of solidarity and have to help,” agreed Martial Fixalis, 39, a businessman manning his own stall.

“We’re European, and it’s our role to help others,” said Josiane Mehlen, who was queueing at a beer stand and turned out to be Morschwiller’s mayor.

There are many explanations for this Gallic insouciance. The French believe in state intervention. Like the Greeks, they have their own sizeable black economy. Unlike the Germans, they are no fiscal saints themselves. Their national debt is 84 per cent of GDP — 6 per cent higher than Britain’s.

“Money is a means to an end. If you can live well with a deficit it’s not a big problem,” chuckled Denis Fauroux, a Mulhouse lawyer, as we ate lunch in his garden and admired the distant mountains of Les Vosges.

The French, with their 35-hour working week and propensity to retire early, do not share the German work ethic evident this week in Ludwigshafen, a four-hour train ride north up the Rhine valley. “Here it’s a Latin culture. The French have more sympathy with the Greeks than the Germans,” observed Marc Sarwatka, 44, the head of a large recruitment agency, over an early evening beer in the elegant Place de la Bourse.

Nor are they such sticklers for rules, as our translator observed when a French driver sped over a pedestrian crossing. “The Germans always stop,” she remarked.

Amongst the cognescenti, there is even a certain pride that President Sarkozy pressed Angela Merkel, the German Chancellor, into backing the €750 billion bailout package.

Read on and comment >>> Martin Fletcher | Wednesday, May 26, 2010