Democracy is an illusion! It’s become a political system fostered by the élite, for the élite, in order to fool the people that they have a stake in the system. In actual fact, they have virtually none. The whole political system in the modern era, despite having noble beginnings, is now used to benefit the few at the expense of the many. – Mark Alexander, June 29, 2018

Friday 30 April 2010

TIMES ONLINE: The Governor of the Bank of England was at the centre of an electoral storm last night after saying that the austerity measures needed to tackle Britain’s budget deficit would be so unpopular that whoever wins next week would not get back into government for a generation.

Mervyn King’s opinion, revealed hours before the prime ministerial debate on the economy, came as a respected think-tank predicted that taxes would have to rise by the equivalent of a 6p-in-the-pound increase in income tax over the next ten years.

The Governor’s prediction was made to the American economist David Hale, who passed on the remarks in an Australian television interview. Mr Hale, who has known Mr King for many years, was commenting on debt levels in major economies when he turned to the British election. “I saw the Governor of the Bank of England last week when I was in London, and he told me whoever wins this election will be out of power for a whole generation because of how tough the fiscal austerity will have to be,” he said.

The Times has also learnt that Mr King gave a further indication of the concerns in Threadneedle Street when he recently told a senior American official that the markets would take a very aggressive view if no credible plan was contained in the Queen’s Speech on May 25. >>> Patrick Hosking, Peter Stiff, Richard Partington | Friday, April 30, 2010

TIMES ONLINE: An increase in the retirement age from 53 to 67, a three-year wage freeze and cuts in public sector pay are understood to be among the austerity measures agreed to by the Greek Government in exchange for a €24 billion (£21 billion) rescue package.

The measures include severe cuts in Civil Service wages, with public servants losing their “13th and 14th” months’ salary and pension entitlements, a reduction of state benefits and tax increases on alcohol and tobacco to help cut the deficit. >>> Emily Ford | Friday, April 30, 2010

THE TELEGRAPH: Tony Blair has denied that Gordon Brown had been a "failure" as Prime Minister, despite Mr Brown's apparent admission that Labour was heading for defeat in the General Election

Visiting Harrow in north-west London, Mr Blair insisted Labour still had "every chance of succeeding" in the general election.

Questioned about whether Mr Brown had failed in his time at Number 10, he said: "No I don't think he's failed at all."

Asked about the prospect that the party could come third in the share of the vote on May 6, the former PM replied: "I don't believe that will happen. I believe Labour has every chance of succeeding." General Election 2010: Tony Blair denies Gordon Brown has 'failed' >>> Robert Winnett, Andrew Porter and Murray Wardrop | Friday, April 30, 2010

Labels:

Gordon Brown,

Tony Blair

THE TELEGRAPH: Greece is just the "tip of the iceberg” of a sovereign debt crisis that has the potential to derail a global recovery, Nouriel Roubini has warned.

Professor Roubini, the New York-based academic who was one of the few to anticipate the scale of the financial crisis, told a panel in California that the buildup of debt is likely to lead to countries defaulting or resorting to inflation to ease the burden on their populations.

Professor Roubini, the New York-based academic who was one of the few to anticipate the scale of the financial crisis, told a panel in California that the buildup of debt is likely to lead to countries defaulting or resorting to inflation to ease the burden on their populations.“While today markets are worried about Greece, Greece is just the tip of the iceberg,” Roubini told the Milken Institute Global Conference in Beverly Hills, California. "The thing I worry about is the buildup of sovereign debt.” >>> | Thursday, April 29, 2010

Labels:

Greece,

soaring debts

THE TELEGRAPH: The euro extended gains against the dollar on Friday as fresh hopes of aid for Greece eased fears about Athens' ability to reduce it massive deficit.

By mid-morning, the single currency was trading above $1.33, up from a one-year low against the dollar of $1.31 hit earlier in the week following downgrades on Greek, Portuguese and Spanish debt.

Stock markets in Germany and France also edged higher as investors took heart at speculation that talks on a rescue loan should be completed in the next few days after it seemed Germany had accepted it must act quickly to support a bail-out. >>> | Friday, April 30, 2010

ARAB NEWS: CHICAGO: On the banks of the sparkling green Chicago River, overlooking the vast expanse of Lake Michigan, the Sheraton Towers Hotel, venue of the first Saudi-American Business Opportunity Forum, was literally bursting at the seams and the action was as much in the corridors and lobbies as in the meeting halls.

In the lull between plenary sessions, in harmonious counterpart to official presentations, friends and colleagues gathered, relationships were forged or renewed, all in an atmosphere of palpable excitement. These spontaneous exchanges were not a distraction from formal program but rather the embodiment of the forum's primary theme: The commitment to a vital and enduring partnership between the two countries.

A notable aspect of the event was the turnout: over 1,000 attendees (many of whom braved skies tainted with ash and smoke in order to make it to Chicago).

The Organizing Committee had expected something close to 400. The overwhelming response on the part of both the US and Saudi delegates is testament to the sense of how vitally important this relationship is.

When asked about his initial reaction to the event, Omar A. Bahalwa of the Committee for International Trade said, "Marvelous! This event is unique. The number of registrants means that this is the largest-ever forum in the history of our two countries. And for the first time, we're targeting small- and medium-sized entrepreneurs. When someone said large crowds and a jam-packed schedule were 'bad news,' David Chaudron, representing Organized Change, laughed and added, 'It's absolutely wonderful that the bad news is the good news!'"

While the forum's theme of "The US and Saudi Arabia: A New Economic Order" was elaborated through a variety of lenses and business perspectives, the subtext of each panel's presentations was the recent global financial crisis and how the messages of that catastrophe have served to catalyze the need for increased communication and cooperation. >>> Peaco Todd, Arab News | Thursday, April 29, 2010

Labels:

business,

Saudi Arabia,

USA

SPIEGEL ONLINE INTERNATIONAL: The current Greek crisis has shown all too starkly the limits of the euro zone's sanction and support mechanisms. If the monetary union is to have a future, it needs new rules to keep members in line and bail them out if necessary.

Europe is in the worst crisis of the postwar era. For months, the governments of the European Union member states have proven to be incapable of developing a convincing solution for the serious debt problems of individual countries, as well as for the reduction of imbalances within the monetary union. Uncertainty among investors has grown in recent weeks, which is primarily attributable to the helplessness of political leaders, and only secondarily to the influence of speculators.

The banking crisis of the fall of 2008 demonstrated that bailout packages approved in response to market pressures fail to have the desired effect in the event of a massive crisis of confidence. At the time, it took the comprehensive approach of the Financial Market Stabilization Act to finally bring about stabilization in Germany. Today, the euro zone needs a common strategy that successfully combines sound public finances with solidarity between member states. On the one hand, the member states must be protected against the excesses of the financial markets. On the other hand, steps must be taken to ensure that the solidarity of member states doesn't undermine efforts to achieve fiscal consolidation in individual countries. In other words, what is needed is the appropriate balance of support and requirements. >>> Peter Bofinger* | Thursday, April 29, 2010

*Peter Bofinger has been a member of the government-appointed German Council of Economic Experts known colloquially here as the "Five Wise Men" since 2004. He is a professor of monetary policy and international economics at the University of Würzburg. His most recent book, published in German, is called "Ist der Markt noch zu retten?" ("Can the Market Still Be Saved?").

Labels:

Eurozone,

financial crisis,

Greece,

the euro

WELT ONLINE: Ausgerechnet die Bezieher kleiner Gehälter und Rentner werden für den griechischen Staatsbankrott aufkommen müssen. Sie zahlen bereits freiwillig in einen Unterstützungsfonds zur Rettung der Nation ein. Die Reichen haben allein in den ersten zwei Monaten dieses Jahres acht Milliarden Euro aus dem Land abgezogen.

Ganz Griechenland wartet darauf, einen ersten Blick aufs Henkerbeil der kommenden Sparmaßnahmen zu werfen. Die Regierung tagte hinter geschlossenen Türen, verhandelte mit den Vertretern vom IMF und der EU. Von produktiven Gesprächen war die Rede und davon, dass man frühestens am Abend, spätestens aber am Sonntag bekanntgeben werde, was auf das Volk zukommt.

Was immer es ist, es wird niemandem gefallen. „Nehmt es von den Reichen“ – so lautet die Standardantwort, wann immer man dieser Tage Griechen fragt, wo denn der Staat Geld für seine horrenden Schulden auftreiben soll. Die Reichen gelten in Griechenland als Profiteure des korrupten Systems, aber zahlen werden sie wohl nicht. Allein in den ersten zwei Monaten des Jahres wurden acht Milliarden Euro Bankeinlagen aus dem Land abgezogen, also etwa so viel wie Griechenland im Mai an Schulden bedienen muss. >>> Von Boris Kalnoky | Donnerstag, 29. April 2010

Labels:

Finanzkrise,

Griechenland

THE TELEGRAPH: US federal prosecutors have opened a criminal investigation into whether Goldman Sachs Group Inc or its employees committed securities fraud in connection with its mortgage trading.

The investigation by the Manhattan US Attorney's Office, which is at a preliminary stage, stemmed from a referral from the US Securities and Exchange Commission, the Wall Street Journal reports.

The SEC already has filed a civil fraud lawsuit against Goldman, charging that it hid vital information from investors about a mortgage-related security.

A spokesman for the office of the Manhattan US Attorney said she could "neither confirm nor deny" the existence of any Goldman investigation. >>> | Friday, April 30, 2010

Labels:

Goldman Sachs

THE WALL STREET JOURNAL: With the IMF and euro-zone governments finalizing the debt-rescue package for Greece, there is almost unanimous agreement on one thing: European governments could hardly have managed it worse if they had tried.

"The Greek crisis has been so severely mishandled by European policy makers that the markets legitimately fear that matters are now beyond repair," argues Alessandro Leipold, a former acting director of the International Monetary Fund's European Department.

Here's another verdict that explicitly links Europe's handling of the crisis with heavy costs for Greece and possibly for the entire euro zone. "The fractious nature of the [European] assistance has likely created permanent damage. Debt will likely stabilize at a higher amount and at a higher economic and social cost than previously expected," Moody's said in a report this week.

There is cold comfort for governments seeking a European solution to a European problem in the knowledge that the institution monitoring Greece's rescue is run by a European. The European in question is IMF managing director Dominique Strauss-Kahn, whose office is in Washington.

The lessons from sovereign debt crises over 30 years suggest they will intensify until the financial markets are confronted with evidence that leads to a sharp shift in investor expectations. If a bailout is being contrived to change those expectations, it needs to meet several conditions. >>> Stephen Fidler | Friday, April 30, 2010

Thursday 29 April 2010

THE TELEGRAPH: The Greek horror story should scare us all, says Edmund Conway. Its problems are not unique.

It has all the ingredients for a perfect Hollywood sequel. The cliffhanger plot kicks off right where its predecessor ended; the cast is stellar, some characters from the original reprising their roles. But this time the stakes are even higher, the mood even tenser.

Greece is on the brink of bankruptcy. Based on almost any yardstick, markets are now betting that the government will default on its debt. At a staggering 18 per cent, the going rate to borrow for a mere two years is similar to the penal rates credit card companies charge their dodgiest customers. The government, International Monetary Fund and European Union have promised, vaguely, to hand over the necessary cash to help tide the country over, but to no avail.

It would be all the more shocking had it not happened before. But Greece's problems today are merely Lehman Brothers redux. This is Global Meltdown 2. Granted, this time it is a country, rather than a mere bank, that faces collapse; this time, the victim may really be too big to fail. But the pattern is eerily familiar: the money starts to run out; investors realise with horror that there is a real chance of failure; the politicians promise that they will stand behind the institution; in a last-gasp attempt to halt the disaster, they ban short-selling; eventually the law of gravity proves irresistible, investors stage an effective run on the banks and the end is nigh.

Faced with such a scenario, there are two options: confront the crisis, knowing you simply may not have the firepower to deal with it, or go running, screaming, for the hills. The head of the Organisation for Economic Co-operation and Development, Angel Gurria, has chosen the latter path, declaring that the contagion is spreading "like Ebola... when you realise you have it you have to cut your leg off in order to survive".

Before we lapse into amateur dramatics, however, let's establish the facts: the market for Greek government debt has effectively frozen, much as the money markets did worldwide in 2007 – the initial trigger point for the crisis. Its banking system, stacked high with those same government bonds, is effectively insolvent. The country had been due to return to investors on May 19 to raise money; if a bail-out cannot be agreed by then, Greece will have no option but to default. But even that deadline is increasingly academic: the country has fallen victim to a run, and as anyone who watched Northern Rock's demise knows, what follows is not usually pretty. How did it come to this? >>> Edmund Conway | Thursday, April 29, 2010

NZZ ONLINE: Auf Italien lastet die grösste Staatsschuld in der EU. Das Land ist aber noch nicht in die Schusslinie der Finanzmärkte geraten. Es scheint solider als die «PIGS» Griechenland, Portugal, Spanien und Irland zu sein.

In den Jahren vor der internationalen Finanzkrise wurde Italien wiederholt als der am schwersten kranke Patient der Euro-Zone geschmäht. Tatsächlich hat die drittgrösste Euro-Wirtschaft die Wirbelstürme an den internationalen Finanzmärkten bisher aber weit besser überstanden als andere hochverschuldete Mitglieder der Europäischen Währungsunion. Die Zins-Spreads zwischen italienischen und deutschen Staatsanleihen zogen weit weniger an als im Fall Griechenlands, Portugals, Spaniens und Irlands. Und auch laut Vertretern führender Rating-Agenturen ist Italien immerhin noch das stabilste Land in der Gruppe der «GIPSI» (Griechenland, Irland, Portugal, Spanien und Italien). Und das I in der anderen pejorativen Abkürzung PIGS stehe für Irland. >>> Nikos Tzermias, Rom | Donnerstag, 29. April 2010

NZZ ONLINE: Finsternis in Griechenland: Griechische Bevölkerung zwischen Verlustängsten und Verzweiflung >>> Von Perikles Monioudis | Mittwoch, 28. April 2010

NZZ ONLINE: Zorn auf die griechische Elite: Verunsicherte Bevölkerung – Furcht vor schmerzhaften Sparmassnahmen >>> Amalia van Gent, Athen | Donnerstag, 29. April 2010

NZZ ONLINE: Berlin streitet um Griechenland-Hilfe: SPD wirft Kanzlerin Merkel vor, die Deutschen zu belügen >>> ddp | Mittwoch 28 April 2010

NZZ ONLINE: Berlin neigt zum fiskalischen Nationalismus: Die Hilfe für Griechenland als Wahlkampfthema >>> Ulrich Schmid, Berlin | Mittwoch, 28. April 2010

WELT ONLINE: 70 Prozent der Griechen lehnen Sparmaßnahmen und das EU-Rettungspaket ab – mit fatalen Folgen: Der Protest der öffentlichen Verkehrsbetriebe führt zu einem Ausfall von zehn Millionen Euro pro Jahr. Auch die Lehrer wollen streiken und so das Abitur ausfallen lassen. Nun drohen die Pharmahersteller.

Auf der Karolustraße ist das alte Griechenland der Maßlosigkeit in vollem Schwung. Bauern marschieren zum Landwirtschaftsministerium, sie wollen mehr Geld vom Staat.

„6000 Euro stehen mir zu, weil die Ernte schlecht war und die Preise gesunken sind“, sagt Korkas Christos. Als er merkt, dass er mit einem deutschen Reporter spricht, folgt eine Belehrung über das hässliche Deutschland. „Wir mögen euch hier nicht.“ Also ist wohl auch deutsches Geld nicht willkommen? „Doch, das Geld wollen wir natürlich. Wir brauchen es.“

Das ist Griechenland, wie es bisher funktionierte: fordern bis zur Selbstzerstörung. Die Krise führt nirgends zur Einsicht, dass man sich ändern muss. Die Regierung tastet fieberhaft nach Wegen, den Volkszorn zu besänftigen. Ab Montag sollen Medikamente per Regierungsbeschluss um 27 Prozent billiger werden. Folge: Die Pharmahersteller wollen keine Medikamente mehr liefern. >>> Von Boris Kalnoky | Donnerstag, 29. April 2010

THE TELEGRAPH: Spain's economy was thrown into chaos on Thursday when its credit rating was cut, sharpening fears that Britain may suffer a similar fate.

The turmoil came just a day after Greece’s rating was cut, increasing concerns of a Europe-wide financial crisis.

The euro fell sharply and the interest rates European governments pay to borrow money jumped after Standard and Poor’s, a credit ratings agency, downgraded Spain.

Last night the government in Madrid appealed for calm, promising an “austerity programme” to cut spending.

But economists fear that events in Spain show that financial “contagion” is spreading from Greece, as investors are scared off investing in any European country with significant government deficits. >>> James Kirkup and Christopher Hope | Thursday, April 29, 2010

THE TELEGRAPH: Britain risks sliding into a Greek-style fiscal crisis unless the next government takes drastic action to cut borrowing, warned Vince Cable, the Liberal Democrat finance spokesman.

Greece is currently in talks with the IMF and the European Union on getting a €45bn bail-out package to prevent a sovereign default, and a slashing of its debt to junk status has sent global financial markets into a tailspin.

"The Greek position is much more serious but is a salutary warning that unless the next government gets seriously to grips with the deficit problems, as we're determined to do, we could have a serious problem," Mr Cable told Reuters Insider television. >>> | Wednesday, April 28, 2010

Wednesday 28 April 2010

TIMES ONLINE: Spain's debt has been downgraded in a further widening of Europe’s government debt crisis.

The move follows its reductions yesterday of Portugal and Greece, which sent shock waves through world markets.

Standard & Poor’s said its decision to downgrade Spain’s credit rating by one notch to AA from AA+ is due to its expectation that the country will suffer an “extended" period of subdued economic growth.

“We now believe that the Spanish economy’s shift away from credit-fueled economic growth is likely to result in a more protracted period of sluggish activity than we previously assumed,” S&P credit analyst Marko Mrsnik said.

The euro dived to another one-year dollar low of $1.3129 following the announcement, reaching a level last seen in late April 2009.

The FTSE 100 index, which had largely recovered its losses by early afternoon as fears about Greece's debt contagion eased, fell 16.91 points or 0.3 per cent to 5,586.61. Germany’s DAX and France’s CAC 40 fell between 0.3 and 1.5 per cent. Spain’s IBEX index fell 3 per cent and Portugal’s PSI 20 was down 1.9 per cent.

Earlier today the European Commission called on credit rating agencies to act responsibly after Standard & Poor’s downgraded Greece’s debt to junk status, sparking a widespread sell-off across world markets. Read on (+ video) >>> Emily Ford, Carl Mortished, David Wighton | Wednesday, April 28, 2010

Labels:

Eurozone,

slow growth,

Spain,

stock markets

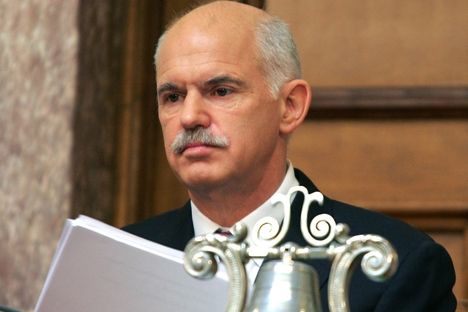

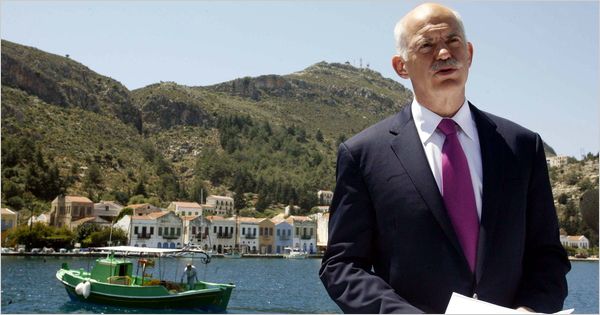

TRIBUNE DE GENÈVE: CRISE | Le Premier ministre grec, Georges Papandréou, a appelé mercredi la zone euro à tout faire pour éviter que "le feu" de la crise ne "se propage à l’économie européenne et mondiale".

Face à la menace d’un défaut de paiement de la Grèce qui ébranle la zone euro et les marchés mondiaux, les responsables européens et du FMI ont multiplié les initiatives pour enrayer la panique, à commencer par la convocation d’un sommet européen le 10 mai. Soucieux d’accélérer le déblocage de l’aide tant attendue, le Premier ministre grec, Georges Papandréou, a appelé mercredi la zone euro à faire le nécessaire pour éviter que "le feu" de la crise ne "se propage à l’économie européenne et mondiale".

Le Premier ministre français François Fillon a assuré, lui, que les pays de la zone euro allaient assumer "toutes leurs responsabilités" à l’égard de la Grèce. Selon lui, "les hésitations du gouvernement allemand" allaient être "dissipées". >>> AFP | Mercredi 28 Avril 2010

THE TELEGRAPH: The Greek debt crisis is spreading “like Ebola” and Europe must act now to protect the stability [of] the financial markets, according to the Organisation for Economic Co-operation and Development.

“It’s not a question of the danger of contagion; contagion has already happened,” OECD secretary general Angel Gurria said.

“This is like Ebola. When you realise you have it you have to cut your leg off in order to survive,” he added, saying the crisis is "threatening the stability of the financial system".

Alistair Darling, the Chancellor, called for Eurozone countries to "urgently" agree a bail-out for Greece or risk a further decline in stock market confidence.

Mr Darling said it was "absolutely essential" that Greece's problems were sorted out "quickly, effectively and decisively", following a torrid 24 hours for world markets.

Asked on LBC Radio about the drop in the FTSE on Tuesday, the Chancellor said stock markets rise and fall but added: "That's my argument about the situation in Greece – we have got to make sure that it gets sorted out.

"But the primary responsibilities are for the other members of the euro group.

"They know that they have got to sort it out. They have promised money, and what I would say is they need to make that money available as soon as possible."

He added: "If we can sort out the problems in Greece quickly, then that will make people more confident."

The crisis in Greece sent stock markets and the euro reeling for a second day as fears grew that it would not be able pay its debts. >>> | Wednesday, April 28, 2010

THE TELEGRAPH: The European Central Bank may soon have to invoke emergency powers to prevent the disintegration of southern European bond markets, with ominous signs of investor flight from Spain and Italy.

Greece’s fortunes were dealt yet another blow as Standard & Poor’s slashed its credit rating to junk status - BB+ - the first time that has happened to a euro member since the single currency was created, pushing yields on 10-year Greek bonds up to a record 9.73pc.

The credit-rating agency also cut Portugal’s sovereign debt ratings by two notches to A-, as the swirling storm hit the country with full-force.

“We have gone past the point of no return,” said Jacques Cailloux, chief Europe economist at the Royal Bank of Scotland.“There is a complete loss of confidence. The bond markets are in disintegration and it is getting worse every day.

“The ECB has been side-lined in the Greek crisis so far but do you allow a bond crash in your region if you are the lender-of-last resort? They may have to act as contagion spreads to larger countries such as Italy. We started to see the first glimpse of that today.”

Mr Cailloux said the ECB should resort to its “nuclear option” of intervening directly in the markets to purchase government bonds.

This is prohibited in normal times under the EU Treaties but the bank can buy a wide range of assets under its “structural operations” mandate in times of systemic crisis, theoretically in unlimited quantities. >>> Ambrose Evans-Pritchard, International Business Editor | Tuesday, April 27, 2010

Labels:

ECB,

Eurozone,

financial crisis,

Greece,

mounting debt

FT: EU chief quells Greek restructuring fears: Herman Van Rompuy, president of the European Council, on Wednesday insisted that there was "no question" of a restructuring of Greece's debt as the country’s capital markets regulator set a two-month ban on short selling of shares on the Athens stock exchange following heavy selling on Tuesday. >>> Kerin Hope in Athens | Wednesday, April 28, 2010

THE WALL STREET JOURNAL: Europe's hopes of containing Greece's credit crisis dimmed as the country's debt woes spread to Portugal, sparking a selloff in markets across the globe and testing the European Union's ability to protect its common currency.

The euro tumbled to its lowest point in a year against the dollar after Standard & Poor's Ratings Services cut Portugal's credit rating two notches and downgraded Greece's debt to "junk" territory, a first for a euro-zone member. The move is bound to worsen Greece's already dire fiscal situation and hamper a recovery. The news sent the bond yields in both countries soaring, a sign of distress.

The Dow Jones Industrial Average fell 213.04 points, or 1.9%, to 10991.99, suffering its worst decline in both point and percentage terms since Feb. 4. The pan-European Stoxx Europe 600 index tumbled 3.1%. As investors opted for the safety of bonds, the yield on Germany's 10-year benchmark was pushed down to 2.99%, moving below 3% for the first time in more than a year. Yields on U.S. Treasurys also dropped as investors bought.

Asian stock markets tumbled in early trading Wednesday on renewed worries about Greece's problems, with Japan's Nikkei 225 stock average shedding 2.8%.

The force of the market reaction to the downgrades suggests that the EU's fraught, months-long effort to stem Greece's debt crisis has all but failed. Portugal's stagnant economy has been viewed as among the weakest in the euro zone, although its deficit and debt levels aren't as high as Greece's. The debt rating downgrade on Tuesday, to A-minus from A-plus, fueled concerns that Portugal is on the same trajectory as its southern neighbor, despite its more solid fiscal position.

Greece's own turmoil was triggered in part by a similar ratings downgrade in December amid growing concerns about its debt. >>> Matthew Karnitschnig, Stephen Fidler and Tom Lauricella | Tuesday, April 27, 2010

TIMES ONLINE: ‘Greece infection’ spreads as stricken nation’s debt is rated junk: Greece plunged deeper into financial turmoil last night after its government bonds were rated as junk by financial markets. The Portuguese government debt also took a hammering after panic spread that a Mediterranean virus of insolvency and bad debts would infect the rest of Europe. >>> Carl Mortished and David Wighton | Wednesday, April 28, 2010

THE TELEGRAPH: Greece acts to stop speculators as debt crisis escalates: Greece has moved to stem panic in the country and stop speculators taking advantage of its escalating debt crisis. >>> Malcolm Moore in Shanghai | Wednesday, April 28, 2010

NZZ ONLINE: In einer emotionalen Rede hat Griechenlands Ministerpräsident Papandreou seine Landsleute zum Zusammenhalt aufgerufen: «Griechenland geht durch eine der schwierigsten Phasen seiner Geschichte», sagte er am Dienstag in Athen.

«Die Beschlüsse, die jetzt gefasst werden müssen, werden von schwerwiegender Bedeutung auch für die kommenden Generationen sein», sagte Papandreou vor der Parlamentsgruppe seiner Panhellenischen Sozialistischen Bewegung (Pasok) weiter. «Lasst uns unser Vaterland neu beleben. Jetzt oder nie», sagte er in der Ansprache, die vom Fernsehen übertragen wurde. >>> sda/dpa | Mittwoch, 28. April 2010

WELT ONLINE: IWF erwägt zusätzliche Milliarden für Griechen: Der Internationale Währungsfonds (IWF) könnte sein Hilfsprogramm für Griechenland um zehn Milliarden aufstocken. Bislang war der IWF bereit, dem Land 15 Milliarden an Hilfsgeldern zu geben. Über ihre Hilfe will die Bundesregierung rasch entscheiden. Doch Ifo-Chef Sinn warnt: Die Griechen werden das Geld nicht zurückzahlen können. >>> dpa/dma | Mittwoch, 28. April 2010

LE TEMPS: Le supplice grec : Les taux d’obligations grecs sur 10 ans dépassaient les 11% à 11h00 ce matin, un nouveau record historique: la situation devient très difficile pour Athènes. Selon le Financial Times, le FMI va débloquer 10 milliards de plus que prévu pour sortir Athènes de la zone de danger. L’UE a aussi annoncé un sommet exceptionnel de la zone euro autour du 10 mai >>> Agences | Mercredi 28 Avril 2010

LE TEMPS: La rigidité d’Angela Merkel fustigée : La presse allemande estime que la gestion du dossier grec tend à isoler Berlin au sein de l’Union européenne >>> Nathalie Versieux | Mercredi 28 Avril 2010

Labels:

der Euro,

Eurozone,

Finanzkrise,

Griechenland,

IWF,

Schulden

Tuesday 27 April 2010

NZZ ONLINE: Nach dem vom Staatsbankrott bedrohten Griechenland gerät auch Portugal weiter unter Druck. Die Ratingagentur Standard & Poor's stufte die Kreditwürdigkeit des Landes auf A- herab. Portugal stehe «erweiterten Risiken» gegenüber, hiess es zur Begründung.

Angesichts der dramatischen Schuldenkrise in Griechenland wächst in EU-Kreisen die Befürchtung, dass demnächst auch Portugal sein Defizit nicht mehr in den Griff bekommen könnte. Die Ratingagentur Standard & Poor's hat die Kreditwürdigkeit Portugals am Dienstag auf A- herabgestuft. Damit reagiere man auf «die erweiterten Risiken, denen Portugal gegenübersteht», hiess es in London.

Portugal gilt mit einem Haushaltsdefizit von 9,4 Prozent des Bruttoinlandprodukts (BIP) nach Griechenland als eines der von der Wirtschaftskrise am meisten gefährdeten Mitglieder der Eurozone. >>> ddp | Dienstag, 27. April 2010

Labels:

der Euro,

Eurozone,

Griechenland,

Portugal

THE NEW YORK TIMES: FRANKFURT — Europe’s debt crisis deepened still further Tuesday after the ratings agency Standard & Poor’s downgraded Greek and Portuguese debt, investors sold off government bonds amid fears of a default, and workers in those Mediterranean nations took to the streets to protest austerity measures.

S.&P. downgraded Greek government debt to junk status, saying in a statement, “Greece’s economic and fiscal prospects lead us to conclude that the sovereign’s creditworthiness is no longer compatible with an investment-grade rating.”

The ratings agency also downgraded Portuguese government bonds, but they remain well above junk status.

“This thing is getting more and more urgent and tense,” said Robert Barrie, head of European economics at Credit Suisse in London. He predicted, though, that markets could settle down once Greece manages to refinance €8.5 billion, or $11.2 billion, in bonds that mature in May. “But it’s anything but calm at the moment,” he added.

As transport workers in both Portugal and Greece went on strike against austerity measures Tuesday, the risk premium on Greece’s bonds set new records even before S.&P. announced the downgrades.

A European Central Bank official warned all euro-zone countries to cut their soaring budget deficits and suggested that Greece may need to impose even harsher austerity measures to bring its debt under control. >>> Jack Ewing | Tuesday, April 27, 2010

THE GUARDIAN: Left and right unite to condemn Greece's 'blank cheque' rescue / Election in Germany's NRW state inflames opposition to bailout

Proposals for a rescue package for debt-ridden Greece have stoked a fierce political row in Germany with opposition towards a bailout growing within parties from both the left and the right.

Germany's reluctance to participate in the deal is summed up today in a single newspaper headline, which read 'Angst surrounds giving Greece blank cheque'.

The rescue plans have even caused a rift within the German government as arguments rage over how much Europe's largest economy should contribute to the fund, under what conditions and even whether any help should be forthcoming at all.

Among the loudest opponents are the liberal Free Democratic Party (FDP), junior coalition partners in chancellor Angela Merkel's government, who have warned against turning the European Union into a 'transfer union' at the expense of Germany, the club's biggest economic power.

"We cannot issue any blank cheques," said the FDP's chief, Guido Westerwelle. "Greece has first and foremost to do its homework and sort out its own household."

Meanwhile leading members of the Christian Social Union, (CSU), the sister party to Merkel's Christian Democrats, have even suggested that Greece should withdraw from the euro. >>> Kate Connolly in Berlin | Monday, April 26, 2010

Labels:

Angela Merkel,

bailout,

debt,

Eurozone,

finance crisis,

Greece,

the euro

ZEIT ONLINE: Die Pläne von US-Präsident Obama zur Regulierung des Finanzmarktes sind vorerst gestoppt: Die Republikaner stimmten im Senat gegen den Beginn des Gesetzgebungsverfahrens.

Die Reform der US-Finanzmärkte verzögert sich: Die Demokraten bekamen im Senat nicht die nötigen 60 Stimmen zusammen, um die Debatte über ihren entsprechenden Gesetzentwurf aufzunehmen. Allerdings kam das Ergebnis nicht überraschend – die Abstimmung galt von vornherein als eine Art Zwischenschritt. Denn aktuell laufen noch die Verhandlungen zwischen Demokraten und Republikanern über eine Kompromissformel. Bereits in dieser Woche könnte die Reform wieder Thema im Senat sein.

Gleichwohl zeigte sich US-Präsident Barack Obama in einer Erklärung "tief enttäuscht" vom Votum der Senatoren. Er griff die oppositionellen Republikaner scharf an, die geschlossen gegen die Eröffnung der Debatte stimmten. Diese verzögerten das Verfahren, um "hinter verschlossenen Türen, wo die Lobbyisten der Finanzwelt die Reform schwächen oder sogar kaputtmachen können, die Diskussionen weiter zu führen", erklärte er. Die Reform gehört zu Obamas wichtigsten innenpolitischen Vorhaben. >>> Zeit Online, dpa, AFP | Dienstag, 27. April 2010

Labels:

Banken,

Barack Obama,

Demokraten,

Finanz,

reforms,

Republikaner

Monday 26 April 2010

WELT ONLINE: Lange Zeit hat Angela Merkel Hilfen für Griechenland abgelehnt. Eine schnelle Hilfe für das krisengebeutelte Griechenland sei mit den Deutschen nicht zu machen, hatte die Bundeskanzlerin die anderen Regierungschefs im Euro-Club wissen lassen. Jetzt will sie doch zahlen. „Madame Non" gibt es nicht mehr.

Die Strategie Angela Merkels ist nicht aufgegangen. Lange Zeit verhandelte die Bundeskanzlerin auf europäischer Ebene über die Hilfe für Griechenland und versicherte gleichzeitig zu Hause, zu dieser Rettungsaktion werde es wohl nie kommen. Die Opposition spricht von einem monatelangen Versteckspiel, für das der Steuerzahler zusätzlich bezahlen müsse. Auch die FDP ist unzufrieden. Doch am Ende werden wohl alle Fraktionen die Griechenland-Hilfe mittragen.

Als „Madame Non“ und „Eiserne Kanzlerin“ war Merkel noch beim letzten EU-Gipfel Ende März in Brüssel tituliert worden. Eine schnelle Hilfe für das krisengebeutelte Griechenland sei mit den Deutschen nicht zu machen, hatte die CDU-Chefin die anderen Regierungschefs im Euro-Club wissen lassen. Der markige Auftritt kam hierzulande bei der Bevölkerung gut an. Innerhalb Europas dagegen warf man den Deutschen vor, sich unsolidarisch zu verhalten. >>> Von Dorothea Siems | Montag, 26. April 2010

WELT ONLINE: Er lobte Richard von Weizsäcker und rechnete mit den "verachtenswerten Typen von Finanzmanagern" ab. Altkanzler Helmut Schmidt hat bei einer Würdigung für den Altbundespräsidenten die Schuldigen an der Wirtschaftskrise attackiert. An deren "Größenwahn" habe die Menschheit noch Jahre zu leiden.

Henry Kissinger war aus den Vereinigten Staaten nach Berlin gekommen, Vaclav Havel reiste aus Prag an und Helmut Schmidt machte sich aus Hamburg auf dem Weg – sie alle ehrten im Berliner Konzerthaus auf Einladung der Körber-Stiftung den Mann, der vor wenigen Tagen sein 90. Lebensjahr vollendete: Richard von Weizsäcker.

Das Leben des einstigen Staatsoberhauptes, sein Anteil an der Ostpolitik und die berühmte Rede vom 8. Mai 1985 kamen mehrfach zur Sprache. Außerdem ging es um die Zukunft Europas und die Weltpolitik, etwa den Umgang mit dem Iran.

Der sozialdemokratische Bundeskanzler a. D. würdigte den Altbundespräsidenten, der einst in der CDU Karriere gemacht hatte. Hinter einem schlichten Tisch in seinem Rollstuhl sitzend, ehrte Helmut Schmidt von Weizsäcker, dessen „Gedankenreichtum“ und seine „moralische Disziplin“.

Schmidt, diesmal ohne Zigarette, sprach von Weizsäcker mit „lieber Richard“ an, hanseatisch vollendet in der Sie-Form. Er benötigte nur wenige Momente, um die im Publikum erwartete „Schmidt Schnauze“ ertönen zu lassen. Von Weizsäcker habe sich nie für persönlichen Luxus interessiert, sondern für diesen „höchstens Verachtung“ übrig gehabt.

Er stehe damit im Gegensatz zu den „verachtenswerten Typen von Bank- und Finanzmanagern“, die mit „zügellosen Größenwahn“ der Welt mit der Wirtschaftskrise eine Rezession beschert hätten, unter der „beinahe die gesamte Menschheit noch Jahre zu leiden haben wird“, polterte Schmidt. >>> Von Daniel Friedrich Sturm | Sonntag, 25. April 2010

THE TELEGRAPH: Once, very wealthy people owned big estates in the country. Now they have homes all over the world and flit to and fro in private jets, yachts - or even submarines. Mark Palmer reports

Even before rumours began to circulate that it was haunted, David and Victoria Beckham had never slept a night in Domaine St-Vincent, the estate in Var-Provence they bought three years ago for £1.5 million. This might seem odd for those of us who can only fantasise about a second home in the South of France, but to the money-bags crowd there's nothing unusual about it at all.

In 2006, the super-rich - that exclusive group - like to see themselves as citizens of the world. They flit from one continent to the next, wheeling and dealing at 30,000 ft, always a few hundred miles ahead of the tax man but only a couple of clicks away from their PAs, solicitors, financial advisers, accountants, wives, mistresses and children.

"I was at an amazingly swanky wedding in Paris recently," says Stephen Bayley, the style guru and art historian. "With my pitiable suburban reflexes, I asked another guest where he was from. He said: 'I've just flown in from Ibiza. I have a flat here in Paris, but my real home is Rio. Anyway, tomorrow I'm going to my apartment in New York.' Then he added, and this is the interesting bit, 'In this milieu, we don't commit adultery, we travel'."

Once upon a time, the rich were rooted. They had big estates in the country. They were chairmen of local charities; they hosted the summer fête. Today, they are rootless - international nomads forever in search of fertile ground in which to sow the seeds of another bumper financial harvest.

Wander down the Bishop's Avenue in north London - which boasts Britain's highest concentration of multi-million pound homes - and you'll find the place practically deserted.

"That's one of the problems we have," says Trevor Abrahmsohn, head of Glentree International, a firm of estate agents that specialises in upscale houses in the area. "For a lot of people, this is their third or fourth home and sometimes they lose interest. They can't be bothered to live here and they can't be bothered to sell."

So, where are they? Well, they're everywhere and nowhere. Some follow the sun while others follow their business investments - and the best chance of seeing them in the same room is likely to be at art sales in London or New York. Never has the phrase "jet set" been quite so appropriate to describe this tribe, were it not for the fact that if you want to buy a plane with room for five passengers, there is a two-year waiting list. And never has the gap between the super-rich and the middle classes been so wide >>> Mark Palmer | Wednesday, June 07, 2006

Sunday 25 April 2010

LE MONDE: Ce n'est encore qu'une niche potentielle mais elle soulève déjà des critiques : la carte bancaire "islamique", dont UM Financial, modeste institution financière de Toronto, a annoncé, début avril, le lancement au Canada puis aux Etats-Unis, inquiète, y compris les musulmans modérés.

La carte iFreedom Mastercard, proposée à tous les Canadiens, musulmans ou non, a été déclarée "conforme aux lois islamiques" par des experts de cette communauté, affirme le président d'UM Financial, le Canadien Omar Kalair. La charia "autorise le commerce mais pas l'usure", rappelle-t-il. De ce fait, ses clients potentiels "laissent dormir leur argent dans les comptes courants des cinq grandes banques du pays" car ils renoncent à des cartes de crédit, des prêts immobiliers ou des investissements financiers, à cause des intérêts sur dépôts ou prêts interdits par leur religion.

Cette carte "islamique", qui devrait être lancée aux Etats-Unis d'ici la fin de l'année, selon M. Kalair, est une carte prépayée, avec un plafond de 6 000 dollars canadiens (4 500 euros), sans intérêt, ni frais mensuels ou de transaction. Elle coûte 50 dollars pour deux ans, avec des avantages, dont une ristourne de 1 % en argent sur les achats de plus de 100 dollars et des rabais sur les vols de la compagnie aérienne des Emirats arabes unis, Etihad Airways. >>> Anne Pélouas (à Montréal) | Vendredi 23 Avril 2010

THE TELEGRAPH: Indian billionaires are on the rise and an increasing number of them are making London their home.

The star exhibit in the National Portrait Gallery's current show, "The Indian Portrait", depicts the 17th-century Emperor Jahangir, resplendent in curled whiskers, golden waistcoat and three-dimensional jewels, holding a globe. The largest- known picture from the Mughal period, it could also be a symbol of the most successful Indians today: rich as kings, highly educated and urbane, they hold the world in the palm of their well-manicured hands. >>> Clive Aslet | Saturday, April 24, 2010

Labels:

billionaires,

India

THE SUNDAY TIMES: FOR Mike Sirakoulis, an unemployed graduate, enough is enough.

“I’ve got three degrees, including a master’s from a leading Australian university, and my prospects are bleak,” he said. “I send out about four or five CVs a week, with minimal response. I was even delayed going to a job interview because of disruption from a civil servants’ strike. It’s not just me. I’m now looking to go back abroad to find a decent job, as are many of my Greek friends.”

Sirakoulis, 33, reflected the sombre mood in Athens yesterday, a day after George Papandreou, the prime minister, bowed to market pressure and asked for a €45 billion (£39 billion) bailout to be activated by the International Monetary Fund (IMF) and European Union (EU).

IMF officials made it clear at their regular spring gathering in Washington yesterday that an economic overhaul would be expected in return.

“I’m happy that the IMF will come in and force Greece to sack civil servants who have been coddled and protected for too long — it’s time for Greece to tidy things up and bring more meritocracy to the system,” Sirakoulis said. But he is ready to give up on the country, and so are many others. Polls show more than half of Greeks would consider leaving; 91% think the IMF will ask for greater austerity; 96% think unemployment will rise — youth unemployment is already more than 30% — and 71% fear social unrest. >>> Philip Pangalos in Athens and David Smith | Sunday, April 25, 2010

Saturday 24 April 2010

THE TELEGRAPH: The collective wealth of Britain’s 1,000 richest people has increased by almost a third in the past year despite the uncertain economy, according to the Sunday Times Rich List 2010.

The multimillionaires are worth £335.5 billion, up £77.265 billion (29.9 per cent) on last year, according to the latest edition of The Sunday Times’ Rich List 2010.

The rise is easily the largest annual increase in the 22 years that the survey has been carried out.

In 1997, when Labour came to power, the collective wealth of the then richest 1,000, was just £98.99 billion. In total, the number of billionaires in this year’s list has risen from 43 to 53.

The findings are likely to prove controversial, coming just ahead of the general election and with spending cuts and tax rises expected from whichever party wins.

Top of the Sunday Times Rich List 2010 again is Lakshmi Mittal, the steel tycoon, whose fortune has more than doubled from £10.8 billion last year to £22.45 billion.

He is followed by: Roman Abramovich, the oil and industry magnate and owner of Chelsea FC, worth £7.4bn - up six per cent on last year; the Duke of Westminster, the property owner, now worth £6.75bn, an increase of four per cent; and Ernesto and Kirsty Bertarelli, whose £5,950 million wealth, based on pharmaceuticals, has increased by 20 per cent. Kirsty Bertarelli is also considered the richest woman in the list. >>> Jasper Copping | Saturday, April 24, 2010

He is followed by: Roman Abramovich, the oil and industry magnate and owner of Chelsea FC, worth £7.4bn - up six per cent on last year; the Duke of Westminster, the property owner, now worth £6.75bn, an increase of four per cent; and Ernesto and Kirsty Bertarelli, whose £5,950 million wealth, based on pharmaceuticals, has increased by 20 per cent. Kirsty Bertarelli is also considered the richest woman in the list. >>> Jasper Copping | Saturday, April 24, 2010

THE NEW YORK TIMES: WASHINGTON — While President Obama struggles to negotiate United Nations sanctions with teeth against Iran, a parallel campaign to turn up the heat is gaining momentum by pressuring American and foreign corporations individually to cut their business ties there.

Two giant American accounting firms, PricewaterhouseCoopers and Ernst & Young, disclosed this week that they no longer had any affiliation with Iranian firms, becoming the latest in a string of companies to publicly shun the Islamic republic. After a similar decision by KPMG this month, that leaves none of the Big Four audit firms with any ties to Iran.

In recent months, other companies have announced that they would stop sales, cut back business or end affiliations with Iranian firms, including General Electric, Huntsman, Siemens, Caterpillar and Ingersoll Rand. Daimler said it would sell a minority share in an Iranian engine maker. An Italian firm said it would pull out after its current gas contracts ended. And the Malaysian state oil company cut off gasoline shipments to Iran, following similar moves by Royal Dutch Shell and trading giants like Vitol, Glencore and Trafigura. >>> Peter Baker | Friday, April 23, 2010

Friday 23 April 2010

THE NEW YORK TIMES: ATHENS — Describing his country’s economy as “a sinking ship,” the Greek prime minister formally requested an international bailout on Friday, an unprecedented step that will test the bonds of the European Union.

In a nationally televised address, Prime Minister George Papandreou said two waves of austerity measures introduced by the government over the past few months “had failed to convince the markets” that Greece would get its finances under control or be able to avert defaulting on a mountain of debt.

“There is the risk of the sacrifices of the Greek people being lost as rates of borrowing continue to rise,” he said, speaking from the Aegean island of Kastellorizo.

“The time has come for us to ask our partners in the E.U. to activate the mechanism we formulated together,” he said, referring to an emergency aid package arranged two weeks ago. The plan foresees up to €30 billion, or $40 billion, in loans from Greece’s euro-zone partners, as well as up to €15 billion from the International Monetary Fund.

The activation of the E.U.-I.M.F. rescue plan, Mr. Papandreou said, “will send a strong message to the markets that the E.U. is not playing their game and will not leave its currency at risk.”

The announcement means that funding from the I.M.F. can be expedited once the board of the fund has approved the terms. The fund is expected to provide €12 billion, according to E.U. officials.

“We are prepared to move expeditiously on this request,” Dominique Strauss-Kahn, the I.M.F. managing director, said in a statement issued in Washington. >>> Niki Kitsantonis and Matthew Saltmarsh | Friday, April 23, 2010

Labels:

Eurozone,

financial rescue plan,

Greece,

IMF

MAIL ONLINE: President Barack Obama rebuked fat cat executives for shady dealings as he pushed last night for sweeping reforms to stop another financial meltdown.

Without laws imposing stronger scrutiny of the financial industry America is doomed to repeat the past, the Presidents believes.

In a speech today at New York's Cooper Union college, near Wall Street, Mr Obama was outlining the need for new financial regulations and explaining what the nation would be risking if the existing framework is allowed to remain in place unchanged.

Echoing remarks he made in the same place two years ago, he said: 'A free market was never meant to be a free licence to take whatever you can get, however you can get it.

'That is what happened too often in the years leading up to the crisis. 'A free market was never meant to be a free licence to take what you can get': Obama slams Wall St in push for more regulation >>> Mail Foreign Service | Friday, April 23, 2010

Labels:

Barack Obama,

greed,

regulation,

Wall Street

Thursday 22 April 2010

WELT ONLINE: Der letzte Akt des Griechen-Dramas hat begonnen. Die neuen Verschuldungszahlen sorgen für einen Crash bei griechischen Staatsanleihen – auch der Euro sackt weiter ab. Investoren stellen sich darauf ein, dass Griechenland die ausgegebenen Anleihen nie mehr in voller Höhe zurückzahlen wird.

An den Kapitalmärkten überschlagen sich die Ereignisse. Am Donnerstag kam es bei griechischen Staatsanleihen zu einem Crash. Der Kurs der Papiere mit zehnjähriger Laufzeit brach binnen weniger Stunden um fast fünf Prozent ein. Das entspricht bei Festverzinslichen normalerweise der Rendite eines ganzen Jahres. Seit Anfang des Monats haben die Titel rund 15 Prozent an Wert verloren. Ein solcher Ausverkauf ist für die Bonds eines Industrielandes ein höchst ungewöhnliches Ereignis. >>> Von Daniel Eckert | Donnerstag, 22. April 2010

Labels:

Eurozone,

Griechenland

THE GUARDIAN: Gordon Brown claims credit for International Monetary Fund plan to impose tough levy on biggest banks' profits and pay

Tough proposals to cut the world's biggest banks down to size by taxing their profits and pay were outlined by the International Monetary Fund tonight in an attempt to spare taxpayers another massive public bailout of the financial sector.

In measures more stringent than Wall Street and the City had expected, the fund called for the introduction of a twin-track approach to the three-year banking crisis that would both force firms to pay for any future support packages and raise new taxes on their profits and remuneration.

The report, prepared by the Washington-based institution for the G20 group of developed and developing nations, was seized upon by Gordon Brown as evidence that his push for an international crackdown on the banking sector was gaining support.

Leaked in advance of the fund's meeting this weekend, the blueprint emerged as the investment bank Goldman Sachs released better than expected first quarter revenues and admitted its bonus and pay pool had reached $5.5bn (£3.3bn) in the first three months of 2010.

The anticipated study called for a financial stability contribution (FSC), which should be paid by all financial institutions, not just banks, and used to bail out weak and failing firms. It would initially be paid at a flat rate but eventually be tailored to suit institutions' size and riskiness.

While banks had been braced for the FSC plan, they were caught unawares by the proposal for a financial activities tax (FAT), which would be based on the profits and the pay structure of the firms. >>> Larry Elliott, Jill Treanor and Patrick Wintour | Tuesday, April 20, 2010

Tuesday 20 April 2010

TIMES ONLINE: Goldman Sachs has announced it will pay its bankers a share of $5.5 billion (£3.5 billion) for three months work just hours after the Financial Services Authority launched a formal investigation into the US bank.

Staff will receive average compensation of $166,000 each for the first quarter of 2010 after the bank beat expectations with a $3.5 billion net profit.

Goldman Sachs has seen $10 billion wiped from its market value since the Securities and Exchange Commission launched a $1 billion lawsuit against the bank, alleging the bank and one of its vice presidents, Fabrice Tourre, committed securities fraud.

Today, Britain’s FSA said that it has decided to start a “formal enforcement investigation” into Goldman Sachs International, its London-based business, after an initial review of the US case.

The bankers’ payouts beat the start of last year, when average remuneration for the first quarter was $149,000. However, this quarter’s pay is still considerably below the $226,000 allocated to each worker in the first quarter of bank’s record year of 2007.

The amount Goldman put aside for pay this quarter is equivalent to 43 per cent of its $12.8 billion net revenue, the lowest first-quarter compensation ratio in the bank’s history.

In a statement today, Goldman’s chairman and chief executive Lloyd Blankfein alluded to the scandal surrounding the bank. Even before Friday’s shock charges, Goldman had already been criticised for accepting a $10 billion state bailout then paying out billions of dollars in bonuses to its employees.

Mr Blankfein said: “In light of recent events involving the firm, we appreciate the support of our clients and shareholders and the dedication and commitment of our people”. >>> Christine Seib | Tuesday, April 20, 2010

Labels:

Goldman Sachs

THE HEW YORK TIMES: Beset by accusations of securities fraud, Goldman Sachs nevertheless showed Tuesday that it was still very good at what it does best: making money.

Earnings for the Wall Street giant rose 91 percent in the first quarter of 2010, to $3.46 billion or $5.59 a share, up from $1.81 billion or $3.39 a share in the same period last year. Revenues increased 36 percent to $12.78 billion, up from $9.42 billion in the quarter a year ago.

Analysts surveyed by Bloomberg had expected revenue of $11.05 billion and earnings of $4.14 a share. >>> Nelson D. Schwartz | Tuesday, April 20, 2010

Labels:

Goldman Sachs

Monday 19 April 2010

THE TELEGRAPH: Goldman Sachs has issued a detailed rebuttal of the fraud charges brought against it in the US as the investment bank begins the fight to clear its name.

The two-page rebuttal, which has been sent to the bank's clients, lists a series of “critical points” that Goldman claims were missing from allegations made by the Securities and Exchange Commission (SEC).

Goldman stands accused of creating a collateralized debt obligation (CDO) referencing the health of the US housing market without telling clients that hedge fund Paulson & Co helped select some of the CDO’s assets and was betting against the product.

Goldman said the “core of the SEC’s case was based on the view that one of our employees misled two professional investors” – IKB, a German bank, and ACA Capital Management, a debt market investor – and that “the employee thereby orchestrated the creation of materially defective offering materials for which the firm bears responsibility.” The employee – Fabrice Tourre, a vice-president in the debt division – was not named by Goldman.

“Goldman Sachs would never condone one of its employees misleading anyone, certainly not investors, counterparties or clients. We take our responsibilities as a financial intermediary very seriously and believe that integrity is at the heart of everything that we do,” the bank said, adding that were any “credible evidence” to appear it would be “the first to condemn it”.

The investment bank insisted that the CDO was marketed solely to “sophisticated investors” and that they had been provided with “extensive information” and “knew the associated risks”. The bank said the investors knew that a such transaction requires a short position – that is someone to bet against it – for “every corresponding long position”. >>> Jonathan Sibun, Deputy City Editor | Monday, April 19, 2010

Labels:

Goldman Sachs

LE FIGARO: Les compagnies annoncent déjà un impact économique plus violent que celui du 11 Septembre. Les tour-opérateurs en appellent à l'aide du gouvernement.

Toute la filière touristique, depuis les compagnies aériennes jusqu'aux voyagistes, commence à faire les comptes de la crise inédite provoquée par la fermeture de la quasi-totalité de l'espace aérien européen. «On essaie péniblement d'anticiper tout en ayant la tête dans le guidon», résume un porte-parole de Nouvelles Frontières, un des principaux voyagistes en France, qui souligne le caractère imprévisible des jours à venir.

D'après l'Organisation de l'aviation civile internationale (OACI), l'impact économique de cet événement va dépasser celui des attentats du 11 septembre 2001. Une catastrophe pour le secteur aérien qui traverse depuis 2008 une des crises les plus graves de son histoire. L'an dernier, selon l'Association internationale du transport aérien (Iata) qui regroupe les compagnies au niveau mondial, la profession a vu son chiffre global reculer de 79 milliards de dollars, pour un déficit cumulé de plus de 11 milliards. 150 millions par jour >>> Par Alexandre Debouté | Lundi 19 Avril 2010

Subscribe to:

Posts (Atom)