NEW YORK TIMES: Thousands of top traders and bankers on Wall Street were awarded huge bonuses and pay packages last year, even as their employers were battered by the financial crisis.

Nine of the financial firms that were among the largest recipients of federal bailout money paid about 5,000 of their traders and bankers bonuses of more than $1 million apiece for 2008, according to a report released Thursday by Andrew M. Cuomo, the New York attorney general.

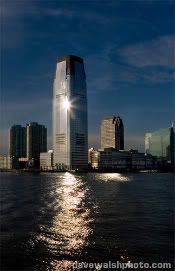

At Goldman Sachs, for example, bonuses of more than $1 million went to 953 traders and bankers, and Morgan Stanley awarded seven-figure bonuses to 428 employees. Even at weaker banks like Citigroup and Bank of America, million-dollar awards were distributed to hundreds of workers.

The report is certain to intensify the growing debate over how, and how much, Wall Street bankers should be paid.

In January, President Obama called financial institutions “shameful” for giving themselves nearly $20 billion in bonuses as the economy was faltering and the government was spending billions to bail out financial institutions.

On Friday, the House of Representatives may vote on a bill that would order bank regulators to restrict “inappropriate or imprudently risky” pay packages at larger banks.

Mr. Cuomo, who for months has criticized the companies over pay, said the bonuses were particularly galling because the banks survived the crisis with the government’s support.

“If the bank lost money, where do you get the money to pay the bonus?” he said.

All the banks named in the report declined to comment. >>> Louise Story and Eric Dash | Thursday, July 30, 2009