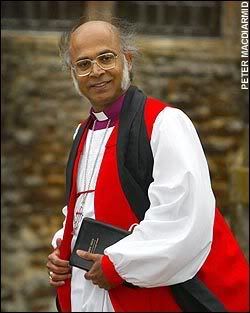

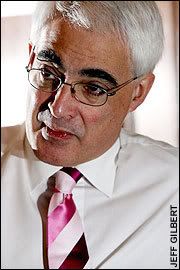

The Barefaced Greed of Bankers and Their Bonuses Beggars BeliefTHE TELEGRAPH:

City pockets are bulging with bonuses, says Boris Johnson. Have the banks no shame? Photo: The Telegraph

Photo: The TelegraphIf you pressed a rifle into the hand of the man in the street and asked him to choose between two targets – an MP or a banker – who do you think would get the bullet? Tricky, eh? It is hard to know which of these two formerly respectable professions has fallen further in public esteem.

Some people might hesitate, like Buridan's ass, the rifle barrel weaving indecisively between two such luscious hate-objects. Most people would simply call for two bullets.

But then let me ask you a slightly different question. Which of the two species has managed to steer itself most effectively through the crisis? Which type of cockroach has scuttled through the nuclear blast of public disapproval? On the face of it, there is an obvious answer, and it is getting more blatant by the day.

Most of the MPs I know seem to be in a state of nervous collapse. Some of them are on suicide watch. Some of them face the task of sacking their wives and selling the house, or possibly the other way round. Some face penury. Never has Parliament been subjected to such protracted humiliation at the hands of the people.

Then look at the bankers, the bankers whose high-rolling risk-taking triggered the recession that has so exacerbated public rage at MPs. The bankers seem to be waltzing off with a song on their lips and their hands in their pockets – at least, their hands would be in their pockets if they were not stuffed with money. And when I say stuffed, I mean bulging, bursting, ballooning with the biggest bonuses you ever saw.

London estate agents say they cannot believe the wheelbarrows of dosh that are suddenly crashing through their doors. Savills says the number of buyers from the financial services sector has risen by 48 per cent in the third quarter of this year, purely in the expectation of yet another ginormous Christmas bonus.

A knuckle-cracking realtor in Knight Frank's Kensington office says he has never seen anything like it: email after email from the boys and girls at Goldman Sachs. "We did our first Goldman's deal in June," he tells the

FT, "and we are now doing five times as many for its employees as for any other bank."

>>> Boris Johnson | Monday, October 19, 2009