It has been announced that Tony Blair wants to ’devote his life to faith’. By ‘faith’ I suppose we are to understand ‘interfaith dialogue’, so as to try and ensure that we all live together in harmony.

This is a noble ambition indeed; unfortunately, however, there is one stumbling block: The nature of Islam!

For ‘interfaith dialogue’ to be meaningful, there has to be a readiness by all parties, in this case especially Jews, Christians, and Muslims, to compromise, for without compromise, interfaith dialogue becomes a meaningless exercise.

In Islam we find an implacable faith, an unyielding belief system founded on totally different principles than both Judaism and Christianity.

Christianity is based on love: The love of God, the love for God, the love of humanity. Islam, by contrast, is not a religion based on love; rather, it is based on total submission to Allah, and where there is no total submission to Him, we find the sword used to rein in the people. Indeed, Muhammad himself announced the sword to be an instrument of faith. Who, then, are we to argue with Muhammad’s declaration? How can we put a positive spin on that?

It is interesting to note that there is a maxim used by Muslims which states the following: ‘To convince stubborn unbelievers, there is no argument like the sword.’ [Source: Washington Irving: Mohammed]

For this reason, if for no other, it is difficult to see what Tony Blair hopes to achieve with his devotion to interfaith dialogue. How does he hope to change the nature of the faith of Islam? It is impossible to change nature. Indeed, can we change the nature of anything? And if this is so, then what hope have we of changing the nature of Islam, especially after more than fourteen hundred years?

The only man who could have changed its nature was the Prophet Muhammad himself. But as he is no longer around to make any changes, it is not going to be possible for mere mortals to change anything in that religion. You see, Islam is not a religion like Christianity anyway. Christianity has evolved, and has undergone a reformation. This reformation was made possible partly because Christianity, being based on the Bible, especially the New Testament, is to all but fundamentalist Christians considered to be a book that is inspired by God. The words contained therein are not generally considered to be God’s actual words.

In this respect, Islam is very different. Islam, as we all know, is based on the Qur’an, and that book is not considered be inspired by Allah; rather, Muslims consider the book to comprise the actual words of Allah as dictated to Muhammad by the Angel Gabriel in the form of a recitation. In fact, the very meaning of ‘Al Qur’an’ is ‘The Recitation’.

The result of this difference between the holy books has led to two quite different civilizations and cultures. Muslims are very defensive of Islamic culture and civilization in a way that Westerners are not defensive of theirs.

Take our leaders. They are reluctant to face up to the fact that we have a huge problem on our hands with Islam in general, and with the rapid growth of Islam in the West in particular. In this reluctance, they are doing us no favours. On the contrary, they are remiss in their duties as guardians of our way of life, as guardians of our Judeo-Christian civilization.

What, for example, are our leaders doing to protect our values and our way of life? Interfaithing will offer no protection; actually, on the contrary, it will probably lead to compromise – the compromise of Westerners. To me it seems like a cop out. It is a smokescreen to enable the top echelons to put profit above principle.

The jihad which is being waged against the West threatens us all. It is not something we can afford to ignore; yet people are ignoring it, largely in the hope that it will go away. It won’t. If anything, it will get worse.

The jihad has many guises. One of the latest is the economic jihad being waged against capitalism. Only this morning, it was reported that there have been calls for Ireland to introduce Shari’ah-compliant finance as a matter of urgency. As a matter of urgency, no less! Why? So that Muslims living and working in Ireland can live their lives according to their faith, without feeling conflicted by the terms and conditions of living in the ‘evil’ capitalist system.

One can but ask oneself one question here: If living under capitalism is so onerous for these Muslims, then why did they come here to live in the first place?

The leaders of finance houses who are working so hard to introduce Shari’ah-compliant financial services and products seem to be oblivious to the fact that Islamic economics is competing in every respect with capitalism. Isn’t it true to say that the interest rate is the keystone of a capitalist economy? Take that keystone away and the whole system will start to fall apart.

In Islam, riba is frowned upon. But let’s get one thing straight: Riba is generally translated as usury, not as the interest rate per se. There is a world of difference between usury, which is the charging of extortionate rates of interest for loans, and the general interest rate which is not to be equated with such extortion. Yet nobody seems to be making any difference between them. The financiers appear to have been hoodwinked into believing that the interest rate is itself frowned upon in Islamic economics. It must be said that one’s definitions in this matter depend on the Islamic scholars one reads: Some scholars frown upon the interest rate altogether, calling it all usury, whilst others take a more liberal approach and make a distinction between a reasonable rate of interest and an extortionate rate.

Whichever is the case, the fact remains that Islamic economics is not compatible with the long-term interests of a capitalist economy. One can but worry about the tentacles of Islam tightening their grip on Western economies. Lest we forget, the old adage, He who pays the piper calls the tune comes to mind. We need not wait to learn that this is indeed true. We can discern the verity of the adage already when we look around us. Take the power of the petrodollar as a case in point. Its power is profound, and it can be felt around the globe.

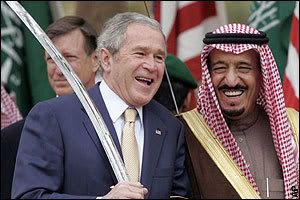

It is one reason why our leaders and business people are reluctant to speak out. They are overcome by greed and fear: They are greedy to earn back the petrodollars, and they are fearful that if they speak out they will incur the wrath of the Muslims living in the West, and cut off our oil supplies into the bargain.

You see, they do not have the stomach for any form of confrontation. The sad reality is, however, that the West will not survive this onslaught without a confrontation of some kind or other. It’s just not possible. Muslims are too determined to replace our Judeo-Christian civilization with an Islamic one, too determined to replace capitalism with an Islamic economic system.

But by confrontation, I do not necessarily think that we need to go to war (though that cannot, of course, be ruled out in the long-run). But we do need to protect our own values and our own way of life. Alas, this is not happening. Our leaders are giving in at every turn. Appeasement of Muslims both at home and abroad is the norm of the day. It will do nothing for the West except accelarate the demise of our civilization, and accelerate the demise of capitalism, too.

Can’t the people in power see what they are doing? Are bankers and financiers so greedy that they are willing to bring down the West for their own short-term gain? Do they not realize that they are playing with fire? Do they really believe that capitalism and Islamic economics can co-exist? Can they really be that ignorant?

Personally, I think they are not; rather, I think these people are out to get all they can before the house of cards is brought down. Remember the fall of communism? Capitalism will fall equally easily if we do not pay more attention. It’s hard to believe, I know. But the introduction of Shari’ah-compliant finance and other Shari’ah-compliant products is just the start. It is the introduction of Shari’ah law by the back the door. Today it’s banking; tomorrow it will be Shari’ah enshrined in the laws of the land, enshrined in the constitutions of Western countries. How foolish our leaders, bankers and financiers are!

Before 9/11, it would have been hard to imagine that the West could have been so weak and unwilling to fight for a way of life we have come to expect and love. But it all started going wrong after those attacks, because we were too reluctant to state the case against Islam, clearly and unequivocally. The politicians have busied themselves making excuses for Islam and have deceived the public in so doing; the business people and bankers have busied themselves making money from the countries awash with petrodollars. And in so doing they have chosen to turn a blind eye to the financing, by Saudi Arabia, of the propagation of Wahhabi Islam in the West.

So what exactly is Tony Blair going to achieve with his lifetime spent interfaithing? Is he merely going to sell the West farther down the river? And in any case, what are his qualifications for doing this job? What does he know about Islam? And where has he learnt that which he does know?

One thing is for certain: People like Tony Blair are not going to learn the true nature of Islam by sitting in five star hotels in Bethlehem, talking to fabulously rich Muslims from oil-rich countries. To learn about the true nature of Islam one has to mix and talk with people at the grassroots level. The rich are generally Western-educated, indulge in alcohol, spend enormous amounts of money in casinos, live in the lap of luxury, and generally do not adhere strictly to their faith. They are also generally well-travelled; so they are not representative of the ordinary man in the Arab street. Ergo, little can be learnt from them when it comes to the faith of Islam.

Isn’t it high time that we all started taking stock? Isn’t it high time that we woke up to the reality which confronts us? Isn’t it high time that we started to put principle before profit?

©Mark Alexander