Democracy is an illusion! It’s become a political system fostered by the élite, for the élite, in order to fool the people that they have a stake in the system. In actual fact, they have virtually none. The whole political system in the modern era, despite having noble beginnings, is now used to benefit the few at the expense of the many. – Mark Alexander, June 29, 2018

June 25, 2009

SPIEGELONLINE INTERNATIONAL: The occupant of the White House may have changed recently. But the amount of ill-advised ideology coming from Washington has remained constant. Obama's list of economic errors is long -- and continues to grow.

The president may have changed, but the excesses of American politics have remained. Barack Obama and George W. Bush, it has become clear, are more similar than they might seem at first glance.

Ex-President Bush was nothing if not zealous in his worldwide campaign against terror, transgressing human rights and breaking international law along the way. Now, Obama is displaying the same zeal in his own war against the financial crisis -- and his weapon of choice is the money-printing machine. The rules the new American president is breaking are those which govern the economy. Nobody is being killed. But the strategy comes at a price -- and that price might be America's position as a global power.

In his fight against terrorism, Bush had the ideologue Dick Cheney at his side. "We must take the battle to the enemy," he said -- and sent out the bomber squadrons toward Iraq on the basis of mere suspicion. The result of the offensive is well known.

Obama's Cheney

Obama's Cheney is named Larry Summers. He is Obama's senior-most economic advisor, and like the former vice president, he is a man of conviction. The financial crisis may be large, but Summers' self-confidence is even larger. More importantly, President Barack Obama follows him like a dog does its master.

The crisis, Summers intoned last week at a conference of Deutsche Bank's Alfred Herrhausen Society in Washington, was caused by too much confidence, too much credit and too many debts. It was hard not to nod along in agreement.

But then Summers added that the way to bring about an end to the crisis was -- more confidence, more credit and more debt. And the nodding stopped. Experts and non-experts alike were perplexed. Even in an interview following the presentation, Summers was unable to supply an adequate explanation for how a crisis caused by frivolous lending was going to be solved through yet more frivolity. >>> Gabor Steingart | Thursday, June 25, 2009

June 18, 2009

THE TELEGRAPH: President Barack Obama has set out the biggest overhaul of the regulation of Wall Street in more than 50 years in an effort to prevent a repeat of the financial crisis.

The central elements of the plan unveiled on Wednesday are:

• An extra layer of regulation for the biggest financial firms in America

• A new agency to scrutinise financial products sold to consumers

• Bringing hedge and private equity funds under federal scrutiny

At the White House, President Obama said that the financial crisis had been a "failure of the entire system." The President went on that "an absence of oversight engendered systematic, and systemic, abuse.”

The proposals, which have been put together by the Treasury, are likely to trigger a political fight in Congress. The financial crisis and the subsequent recession helped propel Obama into the White House and he has said that a 'sweeping overhaul' of the system is one of his top priorities. >>> By Telegraph staff | Wednesday, June 17, 2009

Labels:

Barack Obama,

regulations,

Wall Street

June 13, 2009

THE TELEGRAPH: Dozens of US cities may have entire neighbourhoods bulldozed as part of drastic "shrink to survive" proposals being considered by the Obama administration to tackle economic decline.

The government looking at expanding a pioneering scheme in Flint, one of the poorest US cities, which involves razing entire districts and returning the land to nature.

Local politicians believe the city must contract by as much as 40 per cent, concentrating the dwindling population and local services into a more viable area.

The radical experiment is the brainchild of Dan Kildee, treasurer of Genesee County, which includes Flint.

Having outlined his strategy to Barack Obama during the election campaign, Mr Kildee has now been approached by the US government and a group of charities who want him to apply what he has learnt to the rest of the country.

Mr Kildee said he will concentrate on 50 cities, identified in a recent study by the Brookings Institution, an influential Washington think-tank, as potentially needing to shrink substantially to cope with their declining fortunes.

Most are former industrial cities in the "rust belt" of America's Mid-West and North East. They include Detroit, Philadelphia, Pittsburgh, Baltimore and Memphis.

In Detroit, shattered by the woes of the US car industry, there are already plans to split it into a collection of small urban centres separated from each other by countryside.

"The real question is not whether these cities shrink – we're all shrinking – but whether we let it happen in a destructive or sustainable way," said Mr Kildee. "Decline is a fact of life in Flint. Resisting it is like resisting gravity." >>> By Tom Leonard in Flint, Michigan | Friday, June 12, 2009

June 12, 2009

TAGES ANZEIGER: Einst war sie eine der reichsten Frauen der Welt, stolze Besitzerin von 3000 Paar Schuhen. Jetzt hat Imelda Marcos, die Witwe des früheren philippinischen Diktators, angeblich kein Geld mehr.

Mit Tränen in den Augen stand die glamouröse First Lady der Philippinen in dieser Woche vor Gericht in Manila. Immer wenn Imelda Marcos die philippinische Hauptstadt verlassen will, muss sie sich der Justiz stellen - dies als Konsequenz der andauernden rechtlichen Probleme der Familie Marcos, die vor mehr als 20 Jahren begannen. Unter anderem hatte sich die Familie des früheren philippinischen Diktators Ferdinand Marcos riesige Vermögen angeeignet, die zum Teil auf Schweizer Banken parkiert wurden. >>> vin | Freitag, 12. Juni 2009

WELT ONLINE: Milliarden an Staatshilfen für Unternehmen bei gleichzeitig überhöhten Managergehältern – US-Präsident Obama will nun die Einkünfte der 100 bestbezahlten Beschäftigten bestimmter Konzerne überprüfen lassen

Barack Obama erhöht den Druck auf die Spitzenverdiener in den USA. Staranwalt Kenneth Feinberg soll künftig die Einkünfte der 100 bestbezahlten Beschäftigten in Großkonzernen überprüfen, die milliardenschwere Staatshilfen erhielten, teilte das US-Präsidialamt mit. Dazu zählten die Chefs der Bank of America, der Großbank Citigroup und des Versicherers AIG. Feinberg leitete zuvor den staatlichen Entschädigungsfonds für die Opfer der Anschläge vom 11. September 2001.

Die hohen Gehälter und Bonuseinkünfte der Führungskräfte von Banken und anderen Unternehmen, die in der Finanzkrise ins Trudeln geraten und plötzlich auf Staatsgelder angewiesen waren, hatten in den USA zuletzt Entrüstung ausgelöst.

Die Regierung fordert zudem neue Gesetze, um gewöhnlichen Aktionären mehr Mitsprache bei der Bezahlung von Firmen-Chefs einzuräumen. Zudem verlangte US-Finanzminister Timothy Geithner vom Kongress, der Börsenaufsicht SEC neue Befugnisse bei der Entlohnung von Managern zu erteilen.

"Die Finanzkrise hat viele Ursachen - die Praxis der Bezahlung von Managern hat ebenfalls dazu beigetragen", sagte Geithner. Einkommen müssten an Leistung gekoppelt werden. Eine staatliche Begrenzung für Spitzengehälter solle es aber nicht geben. Allerdings sollten Aufseher und Aktionäre Managergehälter besser kontrollieren können. >>> © ZEIT ONLINE, reuters | Donnerstag, 11. Juni 2009

June 11, 2009

THE TELEGRAPH: Britain "obviously" remains committed to joining the euro following the currency's "success" in helping its members to weather the economic crisis, Lord Mandelson said.

The newly promoted First Secretary of State, speaking in Berlin, hailed the euro as a saviour that had brought stability to the European Union during financial turmoil.

"It is perfectly clear that the euro has been a great success in anchoring its eurozone members during this financial crisis," he said.

"Imagine where all of us would have been if it hadn't. I hope people will recognise that this represents a major vindication for the single currency."

Asked if the British Government would consider joining the euro, Lord Mandelson replied: "Does it remain an important objective for Britain to find itself in the same currency as that single market in which it interacts? Obviously yes."

He added: "That has to be a decision taken on the right terms in the right circumstances and conditions and therefore at a future time than we have now." >>> By Bruno Waterfield in Brussels | Thursday, June 11, 2009

WELT ONLINE: Kalifornien, das Land von Gouverneur Arnold Schwarzenegger, das seit jeher zwischen Chaos und Verheißung taumelt, steht am Rande des Ruins. Unternehmen entlassen, Wohnungen werden zwangsgeräumt. Je größer der Wohlstand, so scheint es, desto unerbittlicher schlägt die Krise zu. Ein Mythos verblasst.

Wo es im Westen nicht mehr weiter geht, bei Capetown, Kalifornien, sind die Blumenkinder noch zu finden. Hier beult sich Amerika am weitesten ins Meer, wenn man Alaska und die Aleuten außer Acht lässt. Dafür krümmt der Highway 101 sich ostwärts durch die Landschaft.

In den Hügeln zwischen Autobahn und Küste siedeln Alt-Hippies, die einem misstrauisch begegnen, weil sie neben Bio-Obst vor allem Hanf anbauen. Die Behörden lassen sie in Ruhe.

Wer sich eine Reise an den Rand der westlichen Zivilgesellschaft sparen möchte, lese T.C. Boyles „Budding Prospects“ über das Scheitern dort. Schon weil der deutsche Titel der Satire heute treffender erscheint: „Grün ist die Hoffnung“.

Grün war auch die Hoffnung Arnold Schwarzeneggers. Als der Schauspieler aus Österreich 2003 als Gouverneur sein Amt antrat, platzten die Tagträume vom Neuen Markt. Der Terminator fackelte nicht lange und beschloss, den Sonnen- in einen Solarstaat zu verwandeln. Seither heißt er „Jolly Green Giant“.

Er zerstampfte herkömmliche Autos, um für das Hybridauto zu werben. Er verbannte Plastiktüten. Er verfügte, bis zum Jahr 2020 auf ein Viertel aller Treibhausgase zu verzichten. Schwarzenegger legte mehr Wert auf die CO2-Bilanz als auf den Staatshaushalt.

Nun bricht die Immobilien- und Finanzmarktkrise über Kalifornien herein und macht nicht nur die grünen Hoffnungen zunichte. Es geht nicht mehr um die Frage, ob sich ausgerechnet Kalifornien klimaneutral verhalten sollte. Sondern um ein selbst kaum noch erneuerbares Land.

Republikanische Parteifreunde verhindern Schwarzeneggers Konjunkturpakete. Das Gemeinwesen wird stillgelegt. Auf Baustellen herrscht Ruhe, Schulen bleiben zu. Im Silicon Valley gehen nun auch in der Ökoindustrie die Lichter aus. Es wird entlassen, es wird zwangsgeräumt, es werden Zuschläge erhoben auf Konsumgüter und auf Benzin, auf Kaliforniens Heiligtümer. Je mehr Wohlstand, umso unerbittlicher die Krise. Es geht um den Mythos Kalifornien und um sein Verblassen. >>> Von Michael Pilz | Mittwoch, 10. Juni 2009

June 10, 2009

THE TELEGRAPH: Britain has been unable to block plans for an EU regulatory machinery with binding legal powers, securing only a loose agreement at a key meeting of EU finance ministers that any proposals should not interfere with budget and taxation policy.

A joint statement yesterday said that legislation to be drawn up by Brussels this autumn “should ensure that such powers should not impinge in any way on the fiscal responsibility of members of states”.

Chancellor Alistair Darling said Britain had upheld the principle that “taxation is clearly a matter for member states”. However, there was no change in the crucial proposal to give EU bodies the ultimate power to override national regulators in areas of banking, insurance and securities.

The Commission aims to create three “authorities” with their own staff, full-time president and independent budget. If there is a dispute between regulators from EU countries over how to proceed, these EU bodies can “settle the matter” by binding mediation. The European Court would have final jurisdiction. The wording would appear to reduce Britain’s Financial Services Authority (FSA) to a subservient arm of the EU apparatus, limited to “daily oversight”. Britain does not have a veto since legislation that affects the “internal market” is decided by qualified majority vote (QMV).

While some East European states share British concerns, Mr Darling is largely isolated in trying to defend the interests of the City of London. EU leaders will grapple with the subject at a Brussels summit later this month.

There is widespread suspicion that Paris and its allies have seized on the financial crisis to rein in Anglo-Saxon capitalism and impose their Colbertiste ideology on the City. >>> By Ambrose Evans-Pritchard | Tuesday, June 09, 2009

THE NEW YORK TIMES: WASHINGTON—The Obama administration on Wednesday appointed a compensation overseer with broad discretion to set the pay for 175 top executives at seven of the nation’s largest companies, which have received hundreds of billions of dollars in federal assistance to survive.

The mandate given to the new compensation official, Kenneth R. Feinberg, a well-known Washington lawyer, reflects the federal government’s increasingly intrusive role in the corporate affairs of deeply troubled companies. From his nondescript office in Room 1310 of the Treasury building, Mr. Feinberg will set the salaries and bonuses of some of the top financiers and industrialists in America, including Kenneth D. Lewis, the chief executive of Bank of America; Vikram S. Pandit, the head of Citigroup, and Fritz Henderson, the chief executive of General Motors.

The compensation of executives at some companies receiving aid provoked a firestorm of political outrage earlier this year. In revising a previous proposal to set pay limits, the administration has decided to take an approach that will leave the success or failure of the effort to curtail high compensation at the assisted companies in the hands of Mr. Feinberg. (Mr. Feinberg himself will not receive any government compensation.) >>> By Stephen Labaton | Wednesday, June 10, 2009

June 07, 2009

REUTERS: BOSTON - The expansion of legal gay marriage across New England could deliver an economic windfall by attracting a youthful "creative class" of workers to a region with an aging population.

In the past year, Connecticut, Vermont, New Hampshire and Maine have joined Massachusetts, which in 2004 became the first U.S. state to allow same-sex weddings, in blessing gay and lesbian weddings.

That makes the region the first in the United States where same-sex couples can move from one state to another while retaining marriage benefits.

New arrivals include John Visser and Nick Keffer, who recently moved to Hartford, Connecticut, from Raleigh, North Carolina. They plan to wed later this month.

"The sole, only reason why we moved was because it was now legal for us to get married here," said Visser, 42. "No other reason whatsoever other than marriage equality. We were perfectly happy in North Carolina."

New England has long burnished an image of tolerance. Early European settlers in the 17th-century escaped religious persecution, although they imposed their own stern doctrines and sometimes expelled dissenters. Later, the region led the right for the abolition of black slavery.

Five out of the region's six states now endorse gay weddings after New Hampshire legalized same-sex marriage on Wednesday, leaving Rhode Island as the sole holdout.

The spread of gay marriage could serve as a recruiting tool for universities, health care companies and financial services firms that dominate the region's economy, experts said. >>> By Scott Malone | Thursday, June 04, 2009

Labels:

creative boost,

economy,

gay-marriage,

New England,

USA

TAGES ANZEIGER: Der ehemalige sowjetische Staatschef Michail Gorbatschow hat die USA und Europa zu Reformen aufgerufen. Das Wirtschaftsmodell des Westens habe sich als unhaltbar erwiesen.

In den letzten Jahren sei deutlich geworden, «dass das neue westliche Modell eine Illusion war, das vor allem den Reichen genützt hat», schrieb Michail Gorbatschow in einem am Sonntag veröffentlichten Gastkommentar für die «Washington Post». Das Modell habe «auf einer Jagd nach Super-Profiten und übersteigertem Konsum für einige wenige, auf uneingeschränkte Ausbeutung der Ressourcen und auf sozialer und umweltpolitischer Verantwortungslosigkeit» basiert, kritisierte er. >>> vin/sda | Sonntag, 07. Juni 2009

THE WASHINGTON POST: We Had Our Perestroika. It's High Time for Yours.

Years ago, as the Cold War was coming to an end, I said to my fellow leaders around the globe: The world is on the cusp of great events, and in the face of new challenges all of us will have to change, you as well as we. For the most part, the reaction was polite but skeptical silence.

In recent years, however, during speaking tours in the United States before university audiences and business groups, I have often told listeners that I feel Americans need their own change -- a perestroika, not like the one in my country, but an American perestroika -- and the reaction has been markedly different. Halls filled with thousands of people have responded with applause.

Over time, my remark has prompted all kinds of comments. Some have reacted with understanding. Others have objected, sometimes sarcastically, suggesting that I want the United States to experience upheaval, just like the former Soviet Union. In my country, particularly caustic reactions have come from the opponents of perestroika, people with short memories and a deficit of conscience. And although most of my critics surely understand that I am not equating the United States with the Soviet Union in its final years, I would like to explain my position.

Our perestroika signaled the need for change in the Soviet Union, but it was not meant to suggest a capitulation to the U.S. model. Today, the need for a more far-reaching perestroika -- one for America and the world -- has become clearer than ever.

It is true that the need for change in the Soviet Union in the mid-1980s was urgent. The country was stifled by a lack of freedom, and the people -- particularly the educated class -- wanted to break the stranglehold of a system that had been built under Stalin. Millions of people were saying: "We can no longer live like this."

We started with glasnost -- giving people a chance to speak out about their worries without fear. I never agreed with my great countryman Alexander Solzhenitsyn when he said that "Gorbachev's glasnost ruined everything." Without glasnost, no changes would have occurred, and Solzhenitsyn would have ended his days in Vermont rather than in Russia.

At first, we labored under the illusion that revamping the existing system -- changes within the "socialist model" -- would suffice. But the pushback from the Communist Party and the government bureaucracy was too strong. Toward the end of 1986, it became clear to me and my supporters that nothing less than the replacement of the system's building blocks was needed.

We opted for free elections, political pluralism, freedom of religion and an economy with competition and private property. We sought to effect these changes in an evolutionary way and without bloodshed. We made mistakes. Important decisions were made too late, and we were unable to complete our perestroika.

Two conspiracies hijacked the changes -- the attempted coup in August 1991, organized by the hard-line opponents of our reforms, which ended up weakening my position as president, and the subsequent agreement among the leaders of Russia, Ukraine and Belarus to dissolve the Union. Russia's leaders then rejected the evolutionary path, plunging the country into chaos.

Nevertheless, when I am asked whether perestroika succeeded or was defeated, I reply: Perestroika won, because it brought the country to a point from which there could be no return to the past.

In the West, the breakup of the Soviet Union was viewed as a total victory that proved that the West did not need to change. Western leaders were convinced that they were at the helm of the right system and of a well-functioning, almost perfect economic model. Scholars opined that history had ended. The "Washington Consensus," the dogma of free markets, deregulation and balanced budgets at any cost, was force-fed to the rest of the world.

But then came the economic crisis of 2008 and 2009, and it became clear that the new Western model was an illusion that benefited chiefly the very rich. Statistics show that the poor and the middle class saw little or no benefit from the economic growth of the past decades. >>> Mikhail Gorbatchev | Sunday, June 07, 2009

Mikhail Gorbachev, the last general secretary of the Communist Party of the Soviet Union, heads the International Foundation for Socio-Economic and Political Studies, a Moscow-based think tank.

June 05, 2009

SAUDI GAZETTE: JEDDAH - US exports to the Kingdom are rising in value, but represent a falling percentage of total Saudi imports, the Saudi British Bank said in its latest report on US-Saudi Trade Relations released on Thursday.

It said, moreover, that a huge expansion in Saudi Arabia’s oil production capacity is set to help meet US and global needs.

The bank noted that the relationship between the US and Saudi Arabia is based on a symbiotic relationship involving an understanding, but not always agreement, about politics, economics and security issues.

The sum of these three elements makes the relationship “special”, but also symbiotic. It is a relationship in which the partners cannot be easily disentangled. It is also a relationship that is often misunderstood and subject to misinformation. For the US, Saudi Arabia is a politico-strategic partner in the Middle East.

Saudi Arabia is a voice of moderation and stability - and undoubtedly the single most important country in the world of energy. It is the driving force that tries to bring moderation in prices and to supply global markets with sufficient oil.

It further said that despite the political proclamations of Washington (made by every US administration since President Nixon), the US will become more dependent on foreign oil, particularly Middle Eastern oil.

The report said US-Saudi trade relations have remained solid, albeit with imports from the US progressively declining over the years as a percentage of total imports. But Saudi Arabia remains one of the US’s top 15 trading partners. >>> Saudi Gazette staff | Friday, June 05, 2009

Labels:

symbiosis,

US-Saudi relationship

June 02, 2009

BBC: Getting to talk to Russian billionaires is never easy. They are notoriously camera-shy, and with good reason.

In Russia, the "oligarchs", as they are generally known, are not very popular. Most ordinary Russians believe that their vast fortunes were stolen during the corrupt privatisations of the 1990s.

So news that the oligarchs are in trouble has been met by many here with a degree of Schadenfreude.

It is - if you like - the story of the incredible shrinking billionaires.

According to Forbes Magazine, a year ago Moscow was home to 74 of them - more than any other city in the world.

Now there are only 27 left. Even those that survive have seen their fortunes slashed.

So imagine my surprise when not one, but two of them, invited me round for a chat.

And they were not just any old second-rate billionaires - one was Russia's richest man, Mikhail Prokhorov.

To put it mildly, Mr Prokhorov is an impressive figure. He stands 2.03m (6ft 8in) in his socks. He is just 43 years old and, even after losing half his fortune, he is still worth close to $10bn (£6.1bn).

Sadly, Mr Prokhorov did not invite me to his country estate, or for a quick spin in his $60m jet.

Instead, it was 20 minutes over coffee in the business-class lounge of a grimy provincial airport. >>> By Rupert Wingfield-Hayes, BBC News, Moscow | Tuesday, June 02, 2009

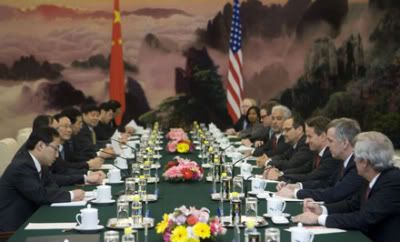

THE TELEGRAPH: Who is going to come out of the economic crisis stronger and with the whip hand - China or America, asks Niall Ferguson.

Two years ago, economist Moritz Schularick and I coined the word "Chimerica" to describe what we saw as the key relationship in the then-booming global economy: China plus America. Cheap Chinese labour was making US corporations highly profitable. Spendthrift American consumers, in turn, were keeping Chinese corporations busy with export orders. And the Chinese monetary authorities were converting export surpluses into dollar denominated reserves with the aim of preventing their own currency from appreciating. The unintended consequence was a multi-billion dollar credit line to the United States, financing America's deficit at rock-bottom rates.

It was those low long-term rates – combined with monetary policy errors by the Fed, excessive bank leverage and reckless financial engineering – that inflated the American property bubble, the bursting of which triggered this crisis.

To simplify the story, think of an unhappy marriage in which one partner does all the saving, while the other does all the spending. (We all know at least one couple like that.) But then the partner with the retail therapy habit maxes out on his/her credit cards. At the same time, the parsimonious partner finds her/his job under threat. What previously was a stable relationship is suddenly on the rocks.

In February, the People's Daily acknowledged the "global importance and influence" of Chimerica, but warned of an impending "period of chillness". Could this be one of those great turning points in history, when the balance of power tilts decisively away from an established power and towards a rising challenger? It is possible. Financial crises often accelerate the gradual shifting of the geopolitical tectonic plates; they are to history what earthquakes are to geology. >>> By Niall Ferguson | Monday, June 01, 2009

Niall Ferguson's 'The Ascent of Money: A Financial History of the World' is published in paperback by Penguin this week

Labels:

America,

China,

economic crisis,

economics,

Niall Ferguson

June 01, 2009

AME Info: Islamic Finance Info Inc., the online company dedicated to offering the Muslim investors financial and investment information service in compliance with Islamic principles, announces the launch of its Islamic Finance web portal at www.islamicfinanceinfo.com.

The ultimate goal of establishing the web portal is to create a platform that is totally dedicated to Islamic Finance so that the relevant information could be disseminated across the globe.

Islamic Finance have been proven to be resillient against the current global financial crisis because it follows the tenets of Shariah that have prohibited its association to elements such as riba, speculation and uncertainty. Now, many people, Muslims and non Muslims alike are curious to find out more about Islamic Finance. IFI's objective is to provide the answers to all things related to Islamic Finance.

The Islamic Finance portal will provide educational information on the basic principles of Islamic finance, the various types of Islamic finance products and the other key principles in Islamic Finance.Membership is currently free and will entitle the users to access the various databases that are currently set up. Amongst those that are available would be the list of Islamic banks. Takaful companies, Shariah scholars and Islamic funds.

Islamic Finance Info Inc. was founded by two investors with extensive experience in Islamic Finance and Information Technology. The company is currently in the process of setting up its various offices. It will eventually have a key presence in Dubai and Singapore respectively. [Source: AME Info] Monday, June 01, 2009

Subscribe to:

Comments (Atom)