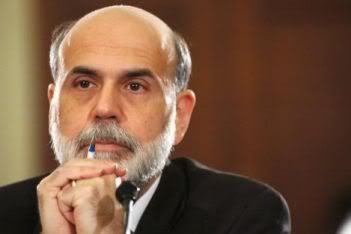

WELT ONLINE: Die drohende Rezession und die Turbulenzen an den Finanzmärkten bringen den US-Notenbankchef in Bedrägnis. Egal was Ben Bernanke derzeit macht, die Kritiker melden sich immer lauter zu Wort. Einige sehen bereits seine Wiederwahl gefährdet.

Ben Bernanke ist nicht zu beneiden. In dieser Woche hat der mächtigste Währungshüter der Welt die Hälfte seiner vierjährigen Amtszeit hinter sich gebracht. Doch nach Feiern dürfte dem Nachfolger Alan Greenspans an der Spitze der amerikanischen Notenbank Federal Reserve (Fed) nicht zumute sein. Seit im Sommer vergangenen Jahres die lange aufgestaute Immobilienblase in den USA geplatzt ist, seit die Börsen trudeln und die Wirtschaft schwächelt, steht Bernanke so stark unter Druck wie nie zuvor. Und egal was der oberste Hüter des Dollar tut oder unterlässt – aus Sicht der Finanzmärkte ist es momentan immer irgendwie das Falsche.

Erst warfen ihm die Beobachter der Notenbank vor, zu zögerlich vorzugehen. Statt die angeschlagene US-Wirtschaft zu retten, warte der oberste Dollar-Hüter einfach nur ab, kritisierten die mächtigen Banker an der Wall Street in New York die mangelnde Effizienz der Fed in Zeiten der Finanzkrise.

Doch nun, da Bernanke die Leitzinsen binnen zwei Wochen um insgesamt 1,25 Prozentpunkte nach unten gedrückt und damit die geldpolitische Reißleine so stark gezogen hat wie kaum ein Fed-Präsident vor ihm, ist es den Beobachtern auch wieder nicht recht. Zwei so große Zinssenkungen in so kurzer Zeit – das zeuge von Panik. Bernanke habe offensichtlich die Nerven verloren, lästerten Fernsehkommentatoren im Anschluss. Längst wird in New York und Washington daher auch darüber spekuliert, ob Bernanke unter diesen Voraussetzungen überhaupt das Zeug dazu hat, nach Ablauf seiner Amtszeit erneut in das oberste geldpolitische Amt gewählt zu werden. Notenbankchef: Ben Bernankes Wiederwahl gerät in Gefahr >>>

Mark Alexander (Paperback)

Mark Alexander (Hardback)