The Risky Business of Islamic FinanceINVESTOR’S BUSINESS DAILY:

Islamofascism: Shariah banking has come into vogue in the West, as even cash-strapped U.S. banks try to attract free-flowing Arab petrodollars. But it poses major risks. Wall Street beware.With oil prices hovering around $100 a barrel, more than $1 trillion in petrodollars are now available annually for global investment. And major U.S. financial institutions, hit hard by the credit crunch, are hungrily eyeing them.

Citibank and Goldman Sachs, for example, are creating investment vehicles that cater to Muslim investors in order to grab some of the billions in management fees in the offing. These products include Shariah-compliant bonds, mutual funds, mortgages, insurance, hedge funds and soon REITs.

Dow Jones Corp. has even created its own index for Islamic-correct investments: the Dow Jones Islamic Index.

While the $800 billion global Shariah market is relatively small, it's growing at a 15% clip, thanks to the oil boom and a resurgence in Islamic fundamentalism, according to the Center for Security Policy. And it's expected to more than double over the next 10 years.

What's the fuss? Money is money, right? Not in this case.

Shariah-compliant finance involves investments and other transactions that have been structured to conform with the orthodox teachings of Islamic law.

That means they can't charge or earn interest — the cornerstone of our credit-driven economy. Nor can they take any stake in haram, or forbidden, industries, including meat and beverage producers (if they process any pork or alcohol); entertainment; gaming; and interest-based financing.

Wall Street is jumping into this hot new market oblivious to the risks not just to the bottom line, but to national security. It knows little about Shariah law and is turning to consultants to create "ethical" products to sell.

Lost in the hype over these Muslim-friendly funds is that they must "purify" their returns by transferring at least 3% into Islamic charities, many of which funnel funds to terrorists. So the Street may unwittingly be helping the evildoers launder blood money.

Shariah law obligates that a sizable portion of zakat, or giving — one of the pillars of Islam — go to support jihad. So many of the purification donations generated from Shariah finance could wind up in the hands of our enemy.

Wall Street also knows little about who's advising these funds. Each has to hire Muslim scholars to bless the investments.

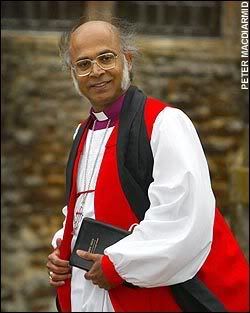

One such scholar is Yusuf Qaradawi, a member of the radical Muslim Brotherhood, which works for the establishment of a global caliphate, and an open supporter of suicide bombings.

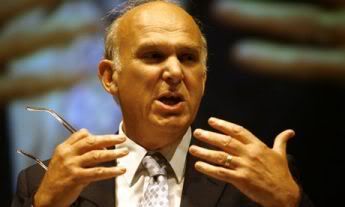

Another is Muhammad Usmani, a radical Pakistani cleric who ran a madrassa that trained thousands of Taliban, according to the Washington-based Center for Security Policy.

Usmani sits on the Shariah supervisory board of the Dow Jones Islamic Index Fund, which is run by the North American Islamic Trust — a Saudi-tied alleged front for the Muslim Brotherhood that holds title to some of the most radical mosques in America. The Justice Department last year named the Islamic Trust an unindicted co-conspirator in a major terror-financing case.

It is this radical group, which may be using investment proceeds to finance new mosques in America, to which Dow Jones has lent its name — something the company, under the new management of Fox News founder Rupert Murdoch, may want to revisit.

The Risky Business of Islamic Finance >>>Mark Alexander (Paperback) Mark Alexander (Hardback)

Mark Alexander (Hardback)