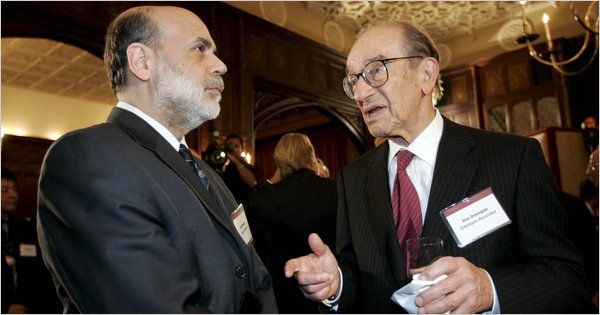

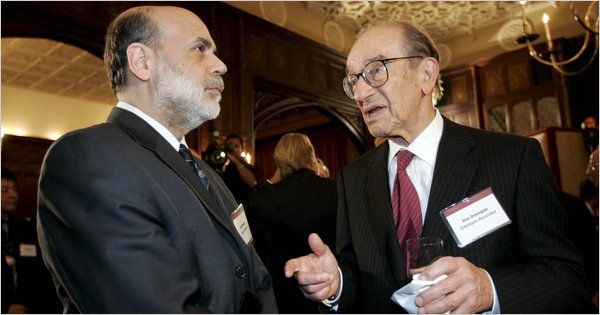

Financial Crisis Was Avoidable, Inquiry Finds The commission’s report finds fault with two Fed chairmen: Alan Greenspan, right, a skeptic of regulation who led the central bank as the housing bubble expanded, and his successor, Ben S. Bernanke, who did not foresee the crisis but then played a crucial role in the response to it. Photograph: The New York Times

The commission’s report finds fault with two Fed chairmen: Alan Greenspan, right, a skeptic of regulation who led the central bank as the housing bubble expanded, and his successor, Ben S. Bernanke, who did not foresee the crisis but then played a crucial role in the response to it. Photograph: The New York TimesTHE NEW YORK TIMES: WASHINGTON — The 2008 financial crisis was an “avoidable” disaster caused by widespread failures in government regulation, corporate mismanagement and heedless risk-taking by Wall Street, according to the conclusions of a federal inquiry.

The commission that investigated the crisis casts a wide net of blame, faulting two administrations, the

Federal Reserve and other regulators for permitting a calamitous concoction: shoddy mortgage lending, the excessive packaging and sale of loans to investors and risky bets on securities backed by the loans.

“The greatest tragedy would be to accept the refrain that no one could have seen this coming and thus nothing could have been done,” the panel wrote in the report’s conclusions, which were read by

The New York Times. “If we accept this notion, it will happen again.”

While the panel, the

Financial Crisis Inquiry Commission, accuses several financial institutions of greed, ineptitude or both, some of its gravest conclusions concern government failings, with embarrassing implications for both parties. But the panel was itself divided along partisan lines, which could blunt the impact of its findings.

Many of the conclusions have been widely described, but the synthesis of interviews, documents and testimony, along with its government imprimatur, give the report — to be released on Thursday as a 576-page book — a conclusive sweep and authority.

>>> Sewell Chan | Tuesday, January 25, 2011