THE WALL STREET JOURNAL: Evan Williams says he learned to lead through trial and error.

Democracy is an illusion! It’s become a political system fostered by the élite, for the élite, in order to fool the people that they have a stake in the system. In actual fact, they have virtually none. The whole political system in the modern era, despite having noble beginnings, is now used to benefit the few at the expense of the many. – Mark Alexander, June 29, 2018

July 31, 2010

THE WALL STREET JOURNAL: Evan Williams says he learned to lead through trial and error.

Labels:

Evan Willians,

leadership style,

Management,

Twitter

SCHWEIZER FERNSEHEN: Wegen des seit Tagen andauernden Streik griechischer Tanklastwagenfahrer bleiben die Tankstellen trocken.

Labels:

Benzin,

Griechenland

July 30, 2010

THE GLOBE AND MAIL: Treasury figures show that one in every 36 one pound coins is counterfeit, at least £41-million worth in circulation

Britain’s tills are awash with fake one pound coins, with a record £41-million worth in circulation.

Treasury figures show that one in every 36 one pound coins is counterfeit, an increase on last year, when one in every 40 was phony. >>> | Tuesday, July 27, 2010

Related >>>

Labels:

fake pound coins,

United Kingdom

July 29, 2010

THE TELEGRAPH: Workers will be able to stay in their jobs into their seventies under new rules to be announced by the Government.

Ministers said they would end the “discrimination” of the Default Retirement Age, which allows companies to force staff out as soon as they turn 65.

Personnel groups welcomed the move, which they claimed would boost productivity and improve employees’ freedom to shape their careers.

Longer working is widely seen as necessary to keep income tax receipts up and reduce the burden on pension funds as Britain’s population ages.

But business leaders warn that employers will find it difficult to plan for the future if they do not know when staff will step down, although compulsory retirement ages could still be enforced in physically demanding jobs such as front line policing.

Older workers who do stay in their posts beyond 65 may also find themselves facing claims that they are not up to the job any more, or that they are keeping younger candidates out of work. Some fear it could lead to more employment tribunal claims from staff who believe they were sacked for being too old.

Ed Davey, the Employment Relations Minister, said: “With more and more people wanting to extend their working lives we should not stop them just because they have reached a particular age. We want to give individuals greater choice and are moving swiftly to end discrimination of this kind.

“Older workers bring with them a wealth of talent and experience as employees and entrepreneurs. They have a vital contribution to make to our economic recovery and long term prosperity.” >>> Martin Beckford and Louisa Peacock | Thursday, July 29, 2010

THE TELEGRAPH: After banning racism and sexism, it's high time to ban ageism >>> Ian Cowie | Thursday, July 29, 2010

Labels:

ageism,

retirement age,

United Kingdom

July 28, 2010

THE TELEGRAPH: Bank of England Governor Mervyn King has warned that high inflation will continue to erode earnings power through next year as the economy faces the threat of 'stagflation'.

Prices rises have consistently defied the Bank's expectations of a slowdown, adding to pressure on households as wage growth remains weak and the Government introduces a strict austerity package.

The Bank's rate-setters are charged with keeping inflation at 2% but the Consumer Prices Index benchmark has been above 3% throughout the year.

However, addressing a committee of MPs, Mr King suggested that they will be reluctant to try to curb the problem by raising borrowing costs from 0.5 per cent any time soon because of the weakness of the economy.

“There will come a point when we will certainly need to ease off the accelerator and return Bank Rate to more normal levels,” Mr King told MPs today.

“I look forward to that time because it will probably be a signal that there is a smoother drive ahead, with the economic outlook improving in a durable way. But I fear there is some considerable distance to travel before we can begin to use the word ‘normal.’” >>> | Wednesday, July 28, 2010

July 27, 2010

SCHWEIZER FERNSEHEN: Die Schweiz ist in Europa beliebt – vor allem bei kaufkräftigen EU-Bürgern, die auf der Suche nach einem Eigenheim sind. Seit den Bilateralen Verträgen mit der EU ist es für sie sehr viel einfacher geworden, in der Schweiz Wohneigentum zu kaufen. Die Nachfrage der Zuzüger aus der EU hat auch Einfluss auf die Immobilienpreise in der Schweiz.

SKY NEWS: The outgoing BP chief executive Tony Hayward says he feels "demonised and vilified" over the Gulf of Mexico oil spill as the firm posts one of the biggest corporate losses in history. Joel Hills reports.

No, Tony, life certainly isn't fair when people who screw-up can walk away from a company with millions in the form of a golden parachute, yet others work all their lives, do things well, but walk away with next to nothing. Life certainly isn't fair. You got that right! – © Mark

Labels:

BP,

CEO,

golden parachutes,

Tony Hayward

SKY NEWS: BP has this morning announced second quarter losses of 11 billion pounds. Charlotte Hawkins has more

Labels:

BP,

huge losses

THE TELEGRAPH: Switzerland is fighting a losing battle to stop massive inflows of funds from investors fleeing sovereign risk in the euro area and the rest of the world, raising the risk of a violent spike in Swiss franc if global debt jitters return.

The Swiss National Bank (SNB) said it lost over 14bn francs (£8.8bn) in the first half of the year in a forlorn attempt to hold down the currency against the euro.

"If we have a US slowdown with a fresh financial crisis, everybody is going to want to buy the Swiss franc, along with bottled water, tins hats, and a shotgun," said David Bloom, currency chief at HSBC. "Now that Japan’s debt is around 200pc of GDP the franc has displaced the yen as the ultimate safe haven."

The franc has appreciated dramatically against the euro since the debt crisis surfaced in Greece and set off a broader worries about the viability of EMU. It strengthened from CHF 1.52 at the end of last year to a record CHF 1.31 earlier this month.

The SNB spent CHF80bn in one month alone trying to prevent the Swiss economy being pulled into a deflation spiral, but each attempt to buy euros has failed to secure any lasting effect. "They are betting against the fundamental trend, which never really works," said Neil Mellor from the Bank of New York Mellon.

Hans Redeker, head of currencies at BNP Paribas, said the surging franc had been driven by capital flight from the eurozone. "If there is any further tension in the EMU banking system, the franc will immediately rise further."

Handelsblatt reported that German citizens in Bavaria are crossing the border to open franc accunts in Zurich as a precaution, repeating a time-honoured tradition in times of stress. The Swiss economy is too small to absorb large inflows without causing huge disruption.

"Without intervention by the SNB, the franc might be on its way to parity against the euro," said Jürgen Büscher, founder of Büscher Private Asset Management in Zurich. Continue reading and comment >>> Ambrose Evans-Pritchard | Wednesday, July 21, 2010

Labels:

flight from euro,

safe haven,

Switzerland

THE TELEGRAPH: Tony Hayward has resigned as chief executive of BP, after the energy giant announced a record $17bn loss this year on the Gulf of Mexico oil spill.

The oil company also said that Bob Dudley, the American in charge of BP’s oil spill response unit, will now take over on October 1 and lead the company through an accelerated programme of $30bn in asset sales. BP made “clean” profits of $5bn, stripping out the effect of inventory changes and exceptionals, but took a $32.2bn pre-tax charge on the oil spill.

This is made up of a $20bn compensation fund for victims, clean-up charges and provisions for funding costs. The “clean” profits are a 74pc rise in last year’s figure of $2.9bn, as a result of higher oil prices and more efficient operations. BP will now press ahead with becoming smaller and more profitable, selling $30bn of exploration and production assets in the next 18 months.

Mr Dudley will also have to navigate a criminal investigation into the spill, a slew of litigation and ward off rivals seeking to pounce on the company's trophy assets. Dudley, who ran BP's troubled Russian joint venture, TNK-BP, said last month that for BP to "remain strong and viable in the US, it has a great deal of work to do." >>> Rowena Mason | Tuesday, July 27, 2010

DAILY EXPRESS: BP Boss Tony Hayward Sent to Siberia in £12m Exit Deal: BP boss Tony Hayward is to be sent to Siberia in a £12million exit deal designed to quell outrage in the United States, it emerged last night. >>> Padraic Flanagan | Tuesday, July 27, 2010

DAILY EXPRESS: BP Boss Tony Hayward Sent to Siberia in £12m Exit Deal: BP boss Tony Hayward is to be sent to Siberia in a £12million exit deal designed to quell outrage in the United States, it emerged last night. >>> Padraic Flanagan | Tuesday, July 27, 2010

Labels:

Bob Dudley,

BP,

BP's record losses,

Tony Hayward

July 26, 2010

SCHWEIZER FERNSEHEN: Trotz der Wirtschaftskrise haben die Schweizer Angestellten letztes Jahr deutlich mehr verdient. So kräftige Aufbesserungen gab es seit acht Jahren nicht mehr. Die Nominallöhne stiegen um 2,1 Prozent, die Reallöhne – dank der zurückgehenden Teuerung – sogar um 2,6 Prozent.

SCHWEIZER FERNSEHEN: Die guten Halbjahreszahlen grosser Schweizer Unternehmen zeugen von einem kontinuierlichen Wirtschaftswachstum in der Schweiz. Doch die Prognostiker sind sich uneins, wie lange dieser Aufwärtstrend anhalten wird.

Labels:

Ökonomie,

Schweiz,

Wirtschaft

CYBERPRESSE: Une source officielle a confirmé lundi que le chef de la direction de BP (BP), Tony Hayward, démissionnerait de son poste en octobre pour accepter un emploi avec TNK-BP, une coentreprise de la pétrolière en Russie.

L'image publique de Tony Hayward était devenue étroitement liée aux ratés de BP dans ses efforts pour maîtriser la fuite de pétrole dans le golfe du Mexique, qui a coûté plusieurs millions de dollars en dommages. >>> La Presse Canadienne, Nouvelle-Orléans | Lundi 26 Juillet 2010

THE GLOBE AND MAIL: BP’s Hayward to resign in October: Embattled CEO will take job with company’s joint venture in Russia, official says >>> Harry R. Weber, New Orleans, The Associated Press | Monday, July 26, 2010

Labels:

BP,

CEO,

resignation,

Tony Hayward

THE TELEGRAPH: As they prepare for holiday reading in Tuscany, City bankers are buying up rare copies of an obscure book on the mechanics of Weimar inflation published in 1974.

Ebay is offering a well-thumbed volume of "Dying of Money: Lessons of the Great German and American Inflations" at a starting bid of $699 (shipping free.. thanks a lot).

The crucial passage comes in Chapter 17 entitled "Velocity". Each big inflation -- whether the early 1920s in Germany, or the Korean and Vietnam wars in the US -- starts with a passive expansion of the quantity money. This sits inert for a surprisingly long time. Asset prices may go up, but latent price inflation is disguised. The effect is much like lighter fuel on a camp fire before the match is struck.

People’s willingness to hold money can change suddenly for a "psychological and spontaneous reason" , causing a spike in the velocity of money. It can occur at lightning speed, over a few weeks. The shift invariably catches economists by surprise. They wait too long to drain the excess money.

"Velocity took an almost right-angle turn upward in the summer of 1922," said Mr O Parsson. Reichsbank officials were baffled. They could not fathom why the German people had started to behave differently almost two years after the bank had already boosted the money supply. He contends that public patience snapped abruptly once people lost trust and began to "smell a government rat".

Some might smile at the Bank of England "surprise" at the recent the jump in Brtiish inflation. Across the Atlantic, Fed critics say the rise in the US monetary base from $871bn to $2,024bn in just two years is an incendiary pyre that will ignite as soon as US money velocity returns to normal. >>> Ambrose Evans-Pritchard | Sunday, July 25, 2010

Related >>>

Labels:

paper money,

Weimar Republic

MAIL ONLINE: The embattled head of BP is on the brink of bailing out today - with a golden parachute to break his fall.

Tony Hayward, who arrived at the company's headquarters in London this morning, will receive a seven-figure payoff and a pension estimated at £584,000 a year.

He will stand down today after three months of abuse left him described as the ‘most hated and clueless man in America’.

The enforced departure of the 53-year-old Briton will top the agenda at a crucial London board meeting today.

He has been widely seen as a ‘dead man walking’ ever since an oil-rig explosion led to the worst-ever environmental disaster in the U.S.

The focus will not be on if he goes but when, and how much it costs. During his 28 years at BP, he has built up a gold-plated £10.8million pension pot which he can start taking at 60.

He is also entitled to a year’s salary, equal to just over £1million.

His departure follows a disastrous series of PR gaffes since 11 died in an explosion on April 20 in the Gulf of Mexico.

One of his most notorious was to admit: ‘I want my life back’, at a time when millions of barrels of oil were gushing into the ocean, wrecking the livelihoods of thousands of Americans.

A few weeks later, his decision to go sailing on his yacht in the Isle of Wight added to suspicions that Mr Hayward was not being suitably contrite. But the level of the fury from America has been extraordinary and relentless despite the fact that BP was not solely responsible for the disaster.

President Obama warned: ‘He wouldn’t be working for me after any of those statements.’

Yesterday a BP spokesman insisted that Mr Hayward, whose family have been the victims of crank phone calls, hate mail and death threats, remains the company’s chief executive.

But his departure is inevitable, and will be the second headline-grabbing exit of a BP chief executive in just three years. In 2007, his predecessor Lord Browne dramatically resigned after admitting lying on oath to a High Court judge. >>> Becky Barrow and Daniel Bates | Monday, July 26, 2010

Labels:

BP,

CEO,

golden parachutes,

Tony Hayward

July 25, 2010

SKY NEWS: Bosses of Britain's top 100 listed companies have seen their pay rise dramatically the last two years, despite a drop in performance targets.

Labels:

executive pay

SCHWEIZER FERNSEHEN: Wie weiter mit den Steueroasen der Welt? Während Europäer und Amerikaner die Schweiz in den Schwitzkasten nehmen, profitieren sie von ihren eigenen Finanzinseln. Ein Beispiel: Jersey im Aermelkanal. Die Insel, auf der schätzungsweise 800 Milliarden Franken gebunkert werden, ist im Besitz der britischen Krone. Die Rundschau hat sich im sehr diskreten Jersey umgesehen.

Labels:

Channel Islands,

Jersey,

St Helier

leJDD.fr: C'est une des familles les plus riches de France. C’était la plus discrète. Une vie rangée, derrière les hauts murs de propriétés splendides à l’abri des regards. Pas de vie tapageuse. Cet édifice a volé en éclats quinze jours après la mort d’André Bettencourt, en novembre 2007. Pour quelles raisons ? Le milliard d’euros de François-Marie Banier n’explique pas tout.

Le trio François- Marie, Liliane et André…

C’est un secret d’initiés que tous ceux qui ont approché les Bettencourt semblent partager. François-Marie Banier était aussi très proche d’André Bettencourt. Intime. "Ce n’est pas tout à fait exact", corrige-t-on dans l’entourage du photographe. "Liliane Bettencourt formait un très beau couple avec son mari, nuance un de leurs proches. Mais ils étaient libres tous les deux." Des personnages de roman, ce couple-là. Liliane Bettencourt, grande et magnifique femme, immensément riche. Et lui, André, un dandy élégant, raffiné. "Deux gentlemen", résume un avocat. >>> L.V. - Le Journal du Dimanche | Dimanche 25 Juillet 2010

LIBÉRATION: «Banier s’est mué en Raspoutine» : Françoise Meyers-Bettencourt, dans son audition mardi, a décrit l’emprise exercée sur sa mère. >>> Par Karl Laske | Samedi 24 Juillet 2010

Liens en relations avec l’article ici et ici

BBC: BP's chief executive Tony Hayward has been negotiating the terms of his exit, with a formal announcement likely within 24 hours, the BBC has learnt.

Mr Hayward has been widely criticised over the Gulf of Mexico oil spill.

BBC business editor Robert Peston said it was likely he would be replaced by his US colleague Bob Dudley, now in charge of the clean-up operation.

BP said Mr Hayward "remains our chief executive and has the full support of the board and senior management".

Our correspondent added that while BP had been preparing for a change at the top for some time, the company was waiting until progress had been made on stemming the leak and until it was possible to quantify the financial costs of the disaster.

BP is due to release its results for the second quarter on Tuesday.

It is expected to reveal a provision of up to $30bn (£19bn) for the costs of capping the well, compensation claims and fines to be paid, resulting in a massive quarterly loss.

BP's board is scheduled to meet on Monday ahead of the results.

Mr Hayward has been with the company for 28 years. >>> | Sunday, July 25, 2010

Labels:

BP,

CEO,

Tony Hayward

July 24, 2010

THE GLOBE AND MAIL: Eccentric developer from humble roots shocks nation by leaving offspring nothing

Yu Pengnian’s journey from poor street hawker to Hong Kong real-estate magnate was already a remarkable one. Then the 88-year-old did something even rarer that shocked many in increasingly materialistic China: He gave it all away.

Saying he hoped to set an example for other wealthy Chinese, Mr. Yu called a press conference in April to announce he was donating his last 3.2 billion yuan (about $500-million) to a foundation he established five years earlier to aid his pet causes – student scholarships, reconstruction after the 2008 Sichuan earthquake, and paying for operations for those like him who suffer from cataracts.

“This will be my last donation,” he announced. “I have nothing more to give away.” >>> Mark MacKinnon, Shenzhen, China | Friday, July 23, 2010

THE GLOBE AND MAIL: China’s richest and most generous >>> | Saturday, July 24, 2010

Labels:

China,

philanthropy,

wealth

BERLINER ZEITUNG: Paris - In der bis in Frankreichs Staatsspitze reichenden «L'Oréal-Affäre» soll jetzt die reichste Frau Europas, Liliane Bettencourt, verhört werden.

Die 87-jährige L'Oréal-Erbin, die im Mittelpunkt des seit Wochen andauernden Spenden- und Steuerskandals steht, wird französischen Medienberichten vom Samstag zufolge nächste Woche vernommen werden. Wie die Wochenzeitung «Paris-Match» auf ihrer Internetseite präzisiert, soll sie in ihrem Stadthaus in dem noblen Pariser Vorort Neuilly-sur-Seine verhört werden. >>> © dpa | Samstag, 24. Juli 2010

Verbundenes hier und hier

Labels:

L’Oréal,

Liliane Bettencourt

Labels:

Islamic finance,

Shariah finance

July 22, 2010

THE GUARDIAN: Cameron's drive for ambassadors in foreign outposts to focus on trade – and arms sales – gets a mixed reception

It's not exactly farewell to Ferrero Rocher, glittering receptions and the flashier parts of diplomatic life. But Britain's men and women in far-flung outposts are being ordered to work harder to promote trade, business and investment. Ethics may not be abandoned, but exports and contracts are now in, big time.

Taking its cue from David Cameron's wish to "refashion" Britain's external relations, the Foreign Office today confirmed the appointment of Simon Fraser, a top trade expert, as its permanent under-secretary – its senior civil servant. Colleagues described Fraser, 52, as a "platinum-level" technocrat whose experience in Paris, Brussels and in senior Whitehall jobs will help him galvanise his department into putting UK plc first.

It still seems unlikely, however, that any more than a handful of business people will be appointed as full-time ambassadors in the way that is common practice in the US.

William Hague, the foreign secretary, set out his stall in a speech in Tokyo last week, promising to "inject a new commercialism into the work of our foreign office and into the definition of … international objectives, ensuring that we develop the strong political relationships which will help British business to thrive overseas".

Hague followed this up with a speech to ambassadors at their annual conference and then with a message to every Foreign Office employee. These have clearly been noted. "Every submission and every brief for a visit now has to include the commercial interests," one senior official told the Guardian today. "The emphasis is new and genuine. It's being put into the bloodstream." >>> Ian Black and Richard Norton-Taylor | Thursday, July 22, 2010

July 20, 2010

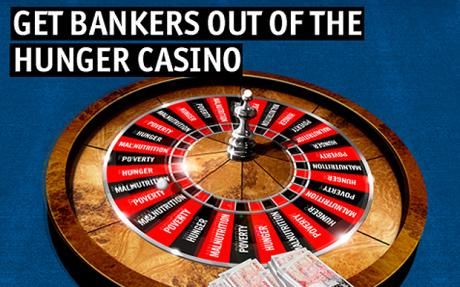

THE TELEGRAPH: Goldman Sachs has angrily defended itself against a public campaign that claims the bank is exacerbating global food crises through its commodity trading operations.

The Wall Street bank has dismissed as "disingenuous and downright misleading" the conclusions by the World Development Movement that its activities have led to increased food prices, food riots, and poverty around the world.

The WDM, a London-based non-governmental organisation, on Monday started an on-line campaign to persuade the public to report Goldman to the Financial Services Authority (FSA) as the biggest bank allegedly distorting commodities markets.

The organisers said they want to put pressure on authorities to limit the ability of banks and hedge funds to trade in commodity futures.

The move came as Armajaro, a hedge fund run by Anthony Ward, was accused of cornering the cocoa market and pushing up prices after buying £650m, or 240,000 tonnes, of cocoa beans.

The campaign follows the publication of a report by the WDM called The Great Hunger Lottery: how banking speculation causes food crises, in which the lobby group accuses banks and hedge funds of "gambling on hunger." The report concludes that commodity trading is "dangerous, immoral and indefensible." >>> Louise Armitstead | Tuesday, July 20, 2010

Labels:

food shortage,

Goldman Sachs,

hunger

MAIL ONLINE: Goldman Sachs is today expected to earmark almost £6billion for its annual salary and bonus pool, handing staff a 15 per cent pay rise.

The windfall means Goldman bankers will take home an average of £356,000 this year.

Many senior deal-makers and star traders will pocket seven or even eight-figure packages, despite the bank's pivotal role in the financial crisis.

The payouts - to be confirmed in the group's financial results for the first half of the year - are likely to anger taxpayers here and in the U.S.

They come days after the Wall Street giant agreed to pay a £356million penalty to settle one of the most explosive fraud cases in U.S. banking history.

Goldman cut a face-saving deal with America's financial watchdog after it was charged with tricking clients into buying an investment that was designed to collapse.

Government-controlled Royal Bank of Scotland lost about £550million in this way, effectively leaving British taxpayers out of pocket.

Goldman is expected to set aside as much as 45 per cent of its first-half turnover for salary and bonuses.

Although markets have been shaken by the eurozone debt crisis, Goldman's turnover is forecast to hit £13.2billion, meaning £5.9billion will be channelled into the pay pool.

For the typical worker at Goldman, this equates to some £178,000 for just six months work. >>> Simon Duke | Tuesday, July 20, 2010

Labels:

Goldman Sachs,

huge bonuses

July 19, 2010

THE WALL STREET JOURNAL: BUDAPEST—Hungary's government said the International Monetary Fund and European Union are ignoring the economic risks of excessive austerity measures and that Budapest can't make deeper spending cuts now, despite a punishing reaction from markets after bailout-loan talks between the two sides broke off this weekend.

The Hungarian currency, the forint, on Monday fell to its lowest level against the euro in more than a year, and the cost of insuring Hungarian government bonds against default jumped sharply after the IMF and EU walked out of talks with Budapest on Saturday, saying the government wasn't doing enough to shrink its budget deficit.

Anxious investors also pushed down the currencies of Hungary's neighbors Poland and the Czech Republic. In the wake of serious debt troubles in Greece, which have prompted Europe-wide efforts to shore up confidence, markets have focused on governments' commitment to strengthening their finances and reining in spending.

"The pressure is clearly going to remain on for some time," said Robert Beange, a senior emerging-markets strategist at Royal Bank of Canada in London. "The markets really want a deal" between the IMF, EU and Hungary. >>> Gordon Fairclough and Margit Feher | Monday, July 19, 2010

Labels:

austerity measures,

Hungary

THE TELEGRAPH: Savers have seen two of the most popular state-backed investment products withdrawn from the market amid the Government’s austerity drive.

National Savings & Investments has pulled its inflation beating and fixed interest savings certificates and cut rates on other products after seeing record inflows of cash.

The group feared demand from consumers could place too high a burden on the taxpayer, at a time when the public finances are under unprecedented strain.

The products had attracted more than a million savers with their promise of high returns and Government-guaranteed security.

The announcement is the latest blow to savers who have seen their income plummet at a time when most savings accounts fail to offer any real rate of return once inflation and tax are taken into account.

NS&I is tasked with raising a fixed amount for the Government coffers each year and can often offer better deals than commercial banks because it is not required to turn a profit.

It is even permitted to make a loss of up to £2bn, to the benefit of its customers. However, it feared this cap could be breached this year because of the unusually high level of demand as consumers seek a safe place to keep their cash as a result of the financial crisis.

Experts yesterday accused the Government of punishing the responsible behaviour of savers as it battles its own deficit. >>> Myra Butterworth, Personal Finance Correspondent | Monday, July 19, 2010

Labels:

austerity measures,

investments,

NSandI,

savings

ZEIT ONLINE: Eine in Deutschland ansässige Bank ist offenbar an iranischen Atomgeschäften beteiligt. Damit hat das Geldinstitut Iran geholfen, die Sanktionen der UN zu umgehen.

Mithilfe einer kleinen Bank in Deutschland hat die iranische Regierung die im Atomstreit verhängten Sanktionen umgangen. Dies berichtet das Wall Street Journal. Demnach wickelte die in Hamburg ansässige Europäisch-iranische Handelsbank (EIH) Milliarden-Geschäfte für iranische Unternehmen ab, die an den umstrittenen Atom- und Rüstungsprogrammen Teherans beteiligt sind. Zu den Kunden des Geldinstituts gehörten auch die iranischen Revolutionsgarden.

Nach Informationen der Zeitung war die EIH im vergangenen Jahr Teil eines groß angelegten Versuchs der iranischen Führung, an den vom UN-Sicherheitsrat verhängten Sanktionen vorbei Geschäfte zu machen. So habe das Institut unter anderem Überweisungen für die iranische Sepah-Bank ausgeführt, die in Europa und den USA wegen ihrer Rolle bei iranischen Rüstungsdeals auf der schwarzen Liste steht. Weiter lesen und einen Kommentar schreiben >>> Zeit Online, AFP | Montag, 19. Juli 2010

Labels:

Atomprogramm,

Hamburg,

Iran,

Sanktionen

July 18, 2010

THE NEW YORK TIMES: As the Obama administration begins to enact the new national health care law, the country’s biggest insurers are promoting affordable plans with reduced premiums that require participants to use a narrower selection of doctors or hospitals.

The plans, being tested in places like San Diego, New York and Chicago, are likely to appeal especially to small businesses that already provide insurance to their employees, but are concerned about the ever-spiraling cost of coverage.

But large employers, as well, are starting to show some interest, and insurers and consultants expect that, over time, businesses of all sizes will gravitate toward these plans in an effort to cut costs.

The tradeoff, they say, is that more Americans will be asked to pay higher prices for the privilege of choosing or keeping their own doctors if they are outside the new networks. That could come as a surprise to many who remember the repeated assurances from President Obama and other officials that consumers would retain a variety of health-care choices. >>> Reed Abelson | Saturday, July 17, 2010

Socialized medicine begins here! Consider this the start of the dismantlement of the old system of medicine provision in the States. By the end, the patient’s opinion will matter far less than the doctor’s. The state will control your healthcare and the management thereof. This is the price Americans will pay for being taken in by a smooth talker! – © Mark

July 17, 2010

FINANCIAL TIMES: Islamic Finance is a method of financing and banking operations that abides by Sharia Law. With the help of Bank of London and Middle East we outline the rules that all sharia-compliant financial products have to adhere to.

What are the main rules for Islamic finance?

Bank of London and the Middle East (BLME), a Sharia compliant bank, says the main principles of Islamic Finance is the avoidance of all haram (harmful) activities such as charging interest. In addition to the prohibition on charging interest, Islamic financial institutions must ensure that ambiguity (gharar) or gambling/speculation (maysair) is minimised in transactions and contracts. Complying with Sharia law also means that Islamic Financial Institutions are not permitted to invest in alcohol, pork, pornography or gambling.

How does Islamic finance work?

The overarching principle of Islamic finance is that all forms of interest are forbidden.

The Islamic financial model works on the basis of risk sharing. The customer and the bank share the risk of any investment on agreed terms, and divide any profits between them.

The main categories within Islamic finance are: Ijara, Ijara-wa-iqtina, Mudaraba, Murabaha and Musharaka. >>> Lucy Warwick-Ching | Wednesday, July 14, 2010

Related articles here and here and here

THE GUARDIAN: Jeremy Hunt, the culture secretary, attacks 'extraordinary and outrageous' waste and predicts tough settlement

The BBC licence fee could be cut as part of the government's public spending austerity drive, the culture secretary has said.

Jeremy Hunt accused the corporation of "extraordinary and outrageous" waste in recent years and warned he could "absolutely" see viewers paying less than the current £145.50 a year after next year's licence fee negotiations with the government.

"The BBC should not interpret the fact that we haven't said anything about the way licence fee funds are used as an indication that we are happy about it. We will be having very tough discussions," he told the Daily Telegraph.

Hunt said the BBC should recognise the "very constrained financial situation" the country was in and it would need to change "huge numbers" of things that it does.

"There's a moment when elected politicians have an opportunity to influence the BBC and it happens every five years. It is when the licence fee is renewed.

"The BBC will have to make tough decisions like everyone else. There are huge numbers of things that need to be changed at the BBC. They need to demonstrate the very constrained financial situation we are now in."

The licence fee review process begins next year and a lower levy could be in place for 2012. >>> David Batty and agencies | Saturday, July 17, 2010

THE TELEGRAPH: The culture department can offer glamour and excitement but Jeremy Hunt has taken charge with the BBC under fire and the arts facing severe budget cuts, writes Andrew Porter.

And he doesn’t just mean the sight of the massed ranks of luvvies screaming at him — as they have been this week — about the impending cuts to arts budgets.

He is referring to the period after this autumn’s spending review. “We are in an unreal period at the moment where everyone knows they are coming but they don’t know what it means. I’m not sure it’s sunk home yet what the effect of these cuts will be,” he says.

“People probably still don’t assume it’s going to affect the services they use every day so it will be a shock when the penny drops.”

With cuts of up to 40 per cent in Whitehall budgets, the Department for Culture Media and Sport, not being a front-line area, is braced for severe pain. Luckily, much of the money for the 2012 Olympics has been allocated already, but there are nagging concerns, not least about the ability to police such a monumental event. Mr Hunt is candid about the threats.

“We’ve got a number of terrorist networks in the UK at the moment actively plotting to cause major, major carnage. So security is going to be an issue,” he says. “It’s an obvious target. We have to assume they are targeting it and we have to be ready for that.”

Mr Hunt will use the Olympics to try to revive competitive sports in schools after years of neglect by Labour. Refreshingly, he is talking the right language.

“The point about competitive sport is it helps people to deal with setbacks and losing,” he says. “Losing is something that happens just as often as winning in all sports — and in fact more frequently for most people. This is something we should welcome and we have got to bury the myth that everyone has to get a prize and it is damaging to people’s self-esteem if you don’t win first prize. Setting up the Olympic school programme is the way to help do that.”

Mr Hunt has been taking flak this week from unlikely places. Selina Scott accused him of failing to follow up his promise in opposition to make the BBC examine how it treats its women. She says the corporation is guilty of “malign sexism and ageism”. But the Culture Secretary is not in the mood to be conciliatory. >>> | Saturday, July 17, 2010

Labels:

austerity measures,

BBC,

licence fee

July 16, 2010

LE FIGARO: Des enfants produisent

du tabac pour Philip Morris : Au Kazakhstan, les fermes produisant du tabac pour le cigarettier Philip Morris font travailler de force des migrants et emploient des enfants, selon un rapport d'Human Rights Watch. L'entreprise américaine reconnait les faits mais tarde à agir. >>> Par Tristan Vey | Vendredi 16 Juillet 2010

FRANKFURTER ALLGEMEINE ZEITUNG: Tabakindustrie – Zigaretten bleiben ein tolles Geschäft : Die Tabakindustrie lebt mit Lokalverboten, Werbebeschränkungen und hohen Steuern. 50 Prozent Gewinn vom Umsatz sind trotzdem immer noch drin. Nur die Jugendlichen machen der Branche Sorgen. Sie rauchen weniger. >>> Von Winand von Petersdorff | Freitag, 16. Juli 2010

THE INDEPENDENT: Crunch time for technology giant as public love affair with brand turns sour

Apple, the £150bn technology giant, is this morning preparing to confront the biggest public relations crisis in its history, amid technical problems afflicting its latest iPhone and a warning that "an emerging pattern of hubris" could wreck the public's love affair with the company.

It emerged yesterday that senior engineers warned early in the development of the new iPhone 4 that its choice of aerial could lead to dropped calls and poor reception. But the company ignored their concerns and when customers first complained about the fault wrongly blamed the problem on a software glitch.

Today the company will hold an emergency press conference in an attempt to reassure customers – and Wall Street – that it has the problem under control.

On Wall Street, where Apple has been the darling of investors for almost a decade since it unleashed the iPod music player on the world, its shares have tumbled, while the company faces a future of increased scrutiny by competition watchdogs and intense competition from newly-emboldened rivals.

Apple has summoned media and industry players to its headquarters in Cupertino, California, in a mood that is a far cry from the launch event with founder Steve Jobs last month. Then, with typical hyperbole, he declared it “the biggest leap forward” since the launch of the original iPhone in 2007, and 1.7 million people snapped up the new device in just the first two days, making it the company’s most successful product launch ever.

But users immediately started complaining of dropped calls and independent consumer tests laid the blame at the door of the phone’s aerial, which is built into the case of the phone. Continue reading and comment >>> Stephen Foley in New York | Friday, July 16, 2010

THE TELEGRAPH: Rarely before have a few coded words in the minutes of the US Federal Reserve caused such an upheaval in the global currency system, or such a sudden flight from the dollar.

The euro rocketed to a two-month high of $1.29 and sterling jumped two cents to almost $1.54 after the Fed confessed that the US economy may not recover for five or six years. Far from winding down emergency stimulus, the bank may need a fresh blast of bond purchases or quantitative easing.

Usually the dollar serves as a safe haven whenever the world takes fright, and there was plenty of sobering news from China and other quarters on Thursday. Not this time. The US itself has become the problem.

"The worm is turning," said David Bloom, currency chief at HSBC. "We're in a world of rotating sovereign crises. The market seems to become obsessed with one idea at a time, then violently swings towards another. People thought the euro would break-up. Now we're moving into a new phase because we're hearing alarm bells of a US double dip."

Mr Bloom said a deep change is under way in investor psychology as funds and central banks respond to the blizzard of shocking US data and again focus on the fragility of an economy where public debt is surging towards 100pc of GDP, not helped by the malaise enveloping the Obama White House. "The Europeans have aired their dirty debt in public and taken some measures to address it, whilst the US has not," he said.

The Fed minutes warned of "significant downside risks" and a possible slide into deflation, an admission that zero interest rates, $1.75 trillion of QE, and a fiscal deficit above 10pc of GDP have so far failed to lift the economy out of a structural slump.

"The Committee would need to consider whether further policy stimulus might become appropriate if the outlook were to worsen appreciably," it said. The economy might not regain its "longer-run path" until 2016.

"The Fed is throwing in the towel," said Gabriel Stein, of Lombard Street Research. "They are preparing to start QE again. This was predictable because the M3 broad money supply has been contracting for months."

The Fed minutes amount to a policy thunderbolt, evidence of how quickly the recovery has lost steam. Just weeks ago the Fed was mapping out withdrawal of stimulus. Continue reading and comment >>> Ambrose Evans-Pritchard, International Business Editor | Thursday, July 15, 2010

Labels:

depression,

recession,

the Fed,

US dollar,

US economy

July 14, 2010

THE INDEPENDENT: The true scale of Britain's national indebtedness was laid bare by the Office for National Statistics yesterday: almost £4 trillion, or £4,000bn, about four times higher than previously acknowledged.

It quantifies the burden that will be placed on future generations, and it is the ONS's first attempt to draw together the "off-balance-sheet" liabilities that have been accumulated by the state. The figures imply a huge "intergenerational transfer" – broadly in favour of today's "baby boomer" generation at the expense of younger people and future generations.

The debt primarily consists of the cost of public sector and state pensions, and of payments promised to private contractors under private finance initiatives. It far exceeds any of the figures so far published for the national debt, the largest current estimate for which is £903bn. That is projected to rise to £1.3trn by 2015.

If the current generation of taxpayers wanted to remove the higher bills facing their children and grandchildren, they would now be paying around 30 per cent more in tax. >>> Sean O'Grady, Economics Editor | Wednesday, July 14, 2010

Labels:

mounting debt,

United Kingdom

YAHOO! TRAVEL: Mediterranean resorts will no longer be the number one destination for UK holidaymakers by the end of this year.

New research by The Co-operative Travel has revealed that once popular resorts in the Western Mediterranean, such as the Costa del Sol and Algarve, are being shunned in favour of holidays in up-and-coming holiday spots.

The new number one area has been nicknamed 'the Mett' after its key destinations: Morocco, Egypt, Tunisia and Turkey.

This year Mediterranean resorts have seen a cumulative fall in bookings of 11.6% compared to the Mett’s increase of 23.4%. If these current trends continue then the two areas will swap places by the end of 2011, with the Mett becoming the number one choice for package holidays.

This would mean that by summer 2012, the Mett would be receiving over 38% of UK package holidaymakers. >>> Paul Johnston | Undated

THE WALL STREET JOURNAL: Britain’s new government has tried to distance itself from Europe’s debt crisis by embarking on painful economic austerity measures. The U.K. pound’s rise against the dollar and euro suggests its strategy is starting to pay off.

The pound has advanced 6% against the crisis-racked euro this year, picking up steam after Britain’s newly elected coalition government announced public-spending cuts and tax rises that have quieted down talk of a much-feared cut to Britain’s credit rating.

Prime Minister David Cameron and Treasury chief George Osborne are betting that Britain’s first order of business is fixing the public finances to avoid a Greece-style debt crisis. Their opposition, the Labour Party, insists that massive spending cuts this year could throw a wrench in Britain’s fragile economic recovery.

But so far investors are giving Britain’s economy the benefit of the doubt. Even as some analysts rub their eyes in disbelief, the U.K. pound continues to experience a big bounce: We’ve gone from one pound buying $1.42 in May to $1.5280. That’s getting closer to the roughly $1.60 level where the pound started the year.

Just about everything is going sterling’s way Wednesday. Good profit numbers from the U.S.’s Intel is fueling optimism and encouraging investors to take riskier positions like the U.K. pound. Fresh figures Wednesday on U.K. unemployment showed Britain’s rate falling to a 15-month low of 4.5% in June.

A day earlier, government reports showed that Britain’s inflation rate remains too high for the Bank of England, with prices rising 3.2% annually. That is raising expectations that the U.K. central bank could move faster than currently expected to raise interest rates. Higher rates make the pound more appealing. >>> Neil Shah | Wednesday, July 14, 2010

July 13, 2010

THE TELEGRAPH: The number of Britons taking foreign holidays slumped last year as a 40-year trend towards more overseas breaks comes to an end.

UK residents made 58.6 million visits overseas in 2009 - 15% fewer than in 2008, the Office for National Statistics (ONS) said.

Visits to the UK by overseas residents also fell in 2009, but at a slower rate, dipping 6.3% from 31.9 million in 2008 to 29.9 million last year.

The ONS said the falls followed a long period of overall growth in international visits to and from the UK.

Visits abroad had grown at an average of 4% per year over the past 25 years and visits to the UK grew at an annual rate of 3.2%.

The decline in 2009 follows small falls of less than 1% in visits abroad in 2007, the first since 1991, and a fall of 2.7% in visits abroad during 2008.

The ONS said it was business visits that were hit hardest in 2009. They fell by 23% among UK residents going abroad and by 19% among overseas residents coming to the UK. >>> | Tuesday, July 13, 2010

THE TELEGRAPH: China's leading credit rating agency has stripped America, Britain, Germany and France of their AAA ratings, accusing Anglo-Saxon competitors of ideological bias in favour of the West.

Dagong Global Credit Rating Co used its first foray into sovereign debt to paint a revolutionary picture of creditworthiness around the world, giving much greater weight to "wealth creating capacity" and foreign reserves than Fitch, Standard & Poor's, or Moody's.

The US falls to AA, while Britain and France slither down to AA-. Belgium, Spain, Italy are ranked at A- along with Malaysia.

Meanwhile, China rises to AA+ with Germany, the Netherlands and Canada, reflecting its €2.4 trillion (£2 trillion) reserves and a blistering growth rate of 8pc to 10pc a year.

Dominique Strauss-Kahn, chief of the International Monetary Fund, agreed on Monday that the rising East is a transforming global force. "Asia's time has come," he said. >>> Ambrose Evans-Pritchard, International Business Editor | Monday, July 12, 2010

Labels:

America,

Britain,

China,

credit rating,

France,

Germany,

UK credit rating

THE TELEGRAPH: Property prices will not recover for another decade and should be viewed as "risky assets", according to PricewaterhouseCooper's Economic Outlook report.

The PwC research, published on Tuesday, not only puts British growth lower than the official Office of Budget Responsibility's (OBR) forecast but also paints a grim picture for home ownership in the UK for the next 10 years.

After 30 years of almost uninterrupted house price rises, Britons have piled in £3,500bn into bricks and mortar. Only pension contributions equal the 39pc of total net private wealth that is invested in the property market.

But according to PwC: "Housing is a risky asset that is not guaranteed to generate positive real returns in the future even though this has been the pattern in the past."

In fact, PwC says, there is a strong possibility that house prices continue to fall for the next five years and could drop further even beyond 2020. According to the report, this would significantly drag back the speed of economic recovery – which PwC claims faces a risk of a double-dip recession. >>> Helia Ebrahimi, Senior City Correspondent | Tuesday, July 13, 2010

Labels:

housing market,

United Kingdom

THE TELEGRAPH: People holding accounts at banks that fail could soon have their savings of up to €100,000 (£84,000) returned to them within a week, under new EU plans.

The draft laws from the European Commission, published on Monday, are designed to shore up confidence in the wake of the financial crisis.

Current minimum compensation levels in member states are set at just €50,000, while people who bank with a collapsed lender face a three-month wait for their money. Read on and comment >>> Emma Rowley | Monday, July 12, 2010

July 12, 2010

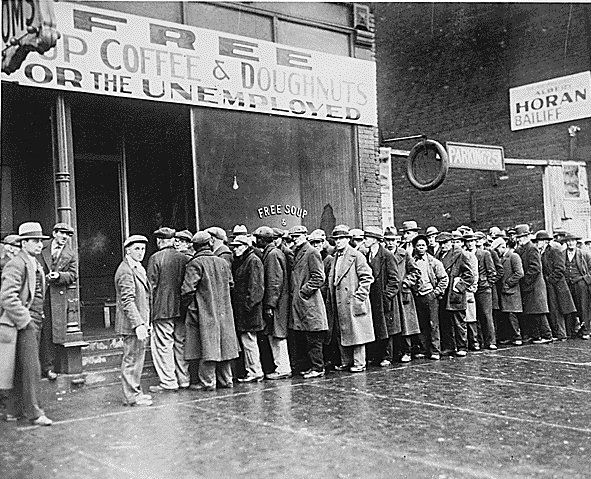

THE GUARDIAN: Six successive quarters of negative economic growth from spring 2008 until autumn 2009 were the toughest for the economy since the Great Depression of the 1930s

The deepest recession in Britain's post-war history was even more severe than previously feared, the government said today.

Fresh information collected by the Office for National Statistics showed that the peak to trough decline in output was 6.4% of gross domestic product rather than the original 6.2% estimate.

The new figures confirmed that the six successive quarters of negative growth from spring 2008 until autumn 2009 were the toughest for the economy since the Great Depression of the 1930s, harsher even than the slump of the early 1980s. Continue reading and comment >>> Larry Elliott, economics editor | Monday, July 12, 2010

Labels:

Great Depression,

UK recession

THE OBSERVER: Gold price may go beyond record high to top $2,000 an ounce as bullion sales rocket and central banks stock up

Goldfinger, the villain of the eponymous James Bond film, hatched a plot to increase the value of his bullion by detonating a nuclear device inside Fort Knox, making America's gold supply radioactive for 60 years. No less exciting, though rather more unsettling, is the real-life drama taking place on the world's financial markets, where investors have piled into gold on fears that capitalism is about to crumble.

As a result, the gold price has soared to record levels, rising 9% this year to reach a peak of $1,264.90 (£834.44) an ounce, with influential names in the world of finance predicting it could top $2,000. Among them is Jim Rogers, the investment guru who called the start of the commodities rally in 1999.

Having narrowly averted a financial Armageddon in 2008, investors are worried the authorities have transferred western indebtedness from banks and consumers to national governments.

In their worst moments, panicky investors and savers visualise a world that has been turned upside down by a sovereign debt crisis that breaks both the euro and flattens the once mighty dollar. As the west sinks into a quagmire of its own making, demand plummets and the world is dragged into another Great Depression. Even the emerging markets of China, India and Brazil are affected as export markets shrivel. Political instability follows, with riots on the streets and unemployment at levels not seen since the 1930s.

This nightmare vision has rattled investors around the word, driving the gold price ever higher. Of all the precious metals, it is the most popular as an investment. Since the earliest times, it has been seen as both a symbol of prosperity and a store of wealth. In the modern era, it has been bought as a hedge against economic, political or social crises, and as protection against the plummeting value of currencies. Continue reading and comment >>> Richard Wachman | Sunday, July 11, 2010

Labels:

gold

July 11, 2010

THE SUNDAY TELEGRAPH: An obscure book about the collapse of the German economy in the 1920s has become cult reading among leading financiers, after a tip from billionaire investor Warren Buffett.

Mr Buffett, known as the Sage of Omaha because of his shrewd investments, apparently told friends that When Money Dies illustrated what could happen today if European governments attempt to spend their way out of the downturn.

Written in 1975 by Adam Fergusson, a one-time adviser to Tory minister Lord Howe, the book charts how the German economy was ruined by hyperinflation after the Weimar government allowed public spending to run out of control.

The collapse of the Weimar Republic cleared the way for Adolf Hitler’s Nazis to seize power in 1933.

After Mr Buffett tipped off a Dutch financier friend about the wisdom of Fergusson's analysis, his book became the talk of right-wing blogs and economics websites, with copies changing hands for up to £1,600.

Old Street Publishing, a small British publisher, has rushed out a new edition to meet demand. >>> Matthew Moore | Sunday, July 11, 2010

Labels:

Warren Buffett,

Weimar Republic

THE SUNDAY TELEGRAPH: As Europe's top diplomat prepares to travel to Turkey, Colin Freeman finds a country not entirely convinced about their need to join the EU.

Sipping a lunchtime latte amid the gleaming skyscrapers of Istanbul's financial district, banker Mehmet Canayaz debated whether the European Union should admit Turkey. The prognosis, he admitted, was not good: a dynamic, forward-looking region would end up shackled to an economy with severe debt, financial instability, and an uncompetitive workforce. Best for Turkey, perhaps, to steer clear of the chaotic Brussels club altogether.

"If we don't join, it will be Europe's problem, not ours," said Mr Canayaz, 25, who was relieved to be watching the recent Euro-zone crash from the outside rather than the inside.

"If they do let us in one day, fine. But in coming years, it will be them that needs us, more than us needing them. Their economy isn't as competitive as it once was."

The issue of whether the EU should be allowed to join Turkey, rather than Turkey being allowed to join the EU, is not the way the Eurocrats of Brussels have often chosen to phrase it since the stalled membership talks formally began in 1987.

But when the EU's Foreign Affairs High Representative, Baroness Ashton, arrives in Ankara for fresh accession talks this week, she may well find no shortage of Turks asking the same question the same way round as Mr Canayaz.

Fed up with being rebuffed by France and Germany, proud of their successful economy, and increasingly keen to court their fellow Muslim neighbours to the East, a growing number of Turkey's 73 million citizens are now wondering whether EU membership is quite so important as it once seemed. While nearly three quarters of Turks supported the idea in 2004, some polls less than half doing so now.

Among those whom Baroness Ashton will meet on Tuesday is the man most closely associated with Turkey's re-assessment of its outside interests, foreign minister Ahmet Davutoglu. A key figure in the AKP party, the moderate Islamist movement that has ruled Turkey for the last eight years, he is widely seen as the prime mover in his country's cooling off towards the West. >>> Colin Freeman in Istanbul | Sunday, July 11, 2010

Labels:

Turkey in EU

Subscribe to:

Comments (Atom)